What Is D&O Insurance and Management Liability Insurance?

As the director or officer of a private company, you may assume your position is relatively low risk compared to the executive management at a public company, which is subject to heavy securities regulation.

Despite the fact that private firms are spared from some of the costly securities lawsuits that plague public companies, the directors and officers of private companies face a significant amount of their own unique risks and challenges. In many cases, these risks have even more fallout for private companies. A director and officer (D&O) lawsuit can take a substantial amount of time and capital to defend, which can cripple or bankrupt a company.

Who Does D&O Insurance & Management Liability Insurance Protect?

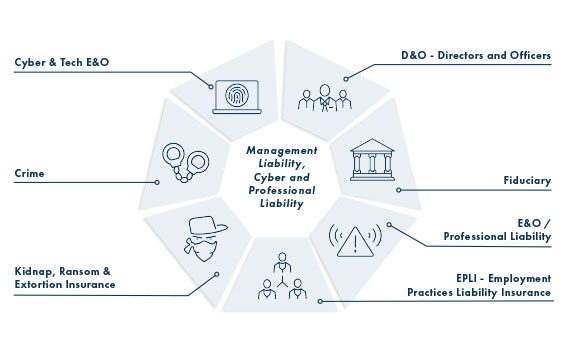

In addition to a D&O suit, cyber insurance solutions and the risks it is designed to protect against have entered the board room more strongly than ever. Because of this and the importance of other Management Liability coverages and its role in risk management, we at The Horton Group argue that a robust Management Liability solutions and Cyber program not only protects a company’s balance sheet, but also the personal assets of its key operators and decision makers. Horton’s management liability insurance helps protect public, private, and non-profit companies from a range of board-level exposures.

To protect your private company from a costly lawsuit, understanding the areas where your business faces the most risk is the first step. Use this list as a starting point to identify the potential liabilities in your company so you can create or tailor a risk management program to attack these issues.