The 24-Hour Company Car Exposure

By Tony Hopkins, CPCU, CIC, CRM

Are you unknowingly increasing your corporate insurance premiums or even worse, the company’s future insurability?

Learn about the 24-hour risk of company cars, how it could impact your organization and other options to reduce the risk.

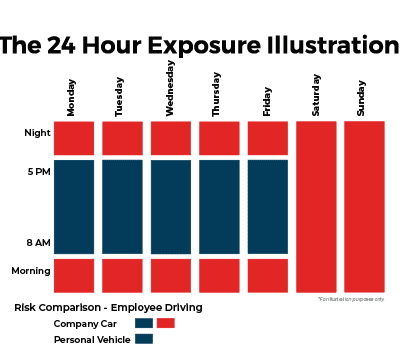

24 Hour Exposure

Due to the difficulty of attracting and retaining talented employees, many companies are providing company cars to corporate officers, managers, and top sales executives as a perk.

While a company car might be an enticing benefit, many businesses are unaware of the “24-hour” exposure a company car creates. Court rulings have sent a clear precedent that there is no distinction between “business” and “non-business” use when employees are driving company-owned vehicles. Liability is assumed by the employer. In addition, a business is likely to be held liable when an employee or employee’s family member has an accident during personal usage.

Risky Examples

The examples are endless, but consider these three situations that could happen to anyone, anytime.

Friday Night Dinner Drinks

Your employee goes out to dinner on a Friday night and drives their company car. That employee has a couple of drinks, drives home, hits a wet spot and slams into another car.

Icey Grocery Run

Following a winter snowstorm, your employee drives their company car to a grocery store. While on the way, the car hits black ice and crosses the center lane into oncoming traffic

Parking Lot Tragedy

While at the store on the weekend in their company car, your employee goes to back out, while at the same time a person in the car next to them, drops something and instinctively goes to reach down to pick it up, right as your employee backs up.

If you currently offer a company car program, it might be time to re-evaluate your position. One increasingly popular approach is to implement a vehicle reimbursement alternative. This will reduce your company’s liability exposure, while still providing most of the same vehicle expense benefits to your employee. A reimbursement program can be implemented through preset allowances or via a cent-per-mile structure.

Hard Market for Auto Insurance

Auto has been one of the most unprofitable lines of coverage for insurance carriers for many reasons, including the vast increase in payouts/settlements, distracted driving, driver shortage, increased cost to replace/repair vehicles, and medical cost inflation. As a result, many carriers are losing money on the Auto insurance coverage they write, leading to higher insurance rates and more underwriting scrutiny. Many carriers have entirely pulled out of the market for writing insurance on trucks.

Following poor loss years, it is common to see very large renewal increases (10%-50%), if the carrier offers a renewal at all. If you have a fleet of trucks, the best thing you can do is to limit your company car exposure.

Underwriters prefer no company cars on the policy, although regularly accept Owners and Key Executives, as they are deemed to be lower risk than salespeople and managers. Our recommendation is to remove as many company cars as you can to reduce risk and become more attractive in the eyes of the Underwriter.

Alternatives to a Company Car Program

With a little effort and no additional cost, your company can easily reduce operational risk by implementing a vehicle reimbursement program in lieu of a company car program.

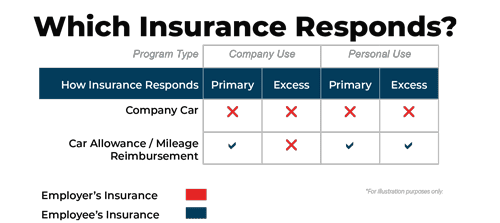

There are generally three options for handling vehicles driven by your employees: offer company-owned or leased vehicles, car allowances, or mileage reimbursement.

Company Car

With this type of program, firms purchase or lease vehicles for employees. Generally, companies pay for fuel, licenses, maintenance, and taxes, which can be very costly. In addition, early vehicle lease terminations can arise in the case of employees leaving the company.

Car Allowance

Car allowances fall into two categories: accountable and non-accountable. Accountable plans are excluded from an employee’s taxable income and are deductible business expenses for an employer. For this type of plan, employees receive a pre-set stipend on a regular basis for vehicle usage. Employees must then keep a log tracking business miles. Any part of the allowance used for business is not considered to be waged, and therefore not subject to income tax.

A non-accountable plan does not separate business and personal vehicle usage and is considered to be supplemental wages for employees. This type of allowance is subject to income tax.

Mileage Reimbursement

This is considered the most basic automobile policy. Employees are reimbursed on a cents-per-mile basis for business miles driven. The IRS’s website, www.irs.gov, posts standard mileage rates. These reimbursements are not considered taxable income.

The following are important steps toward developing a vehicle reimbursement program:

- Title all vehicles in your employees’ names

- Require employees to purchase personal liability insurance on their vehicles. At a minimum, they should obtain $500,000 in auto liability coverage. In general, $1 million or more is recommended by combining underlying auto limits with personal umbrella policies.

- Obtain proof of coverage and conduct periodic audits.

- If you choose, reimburse your employees for regular vehicle maintenance, insurance, and fuel.

- Obtain a signed Motor Vehicle Record (MVR) authorization form from your employee, which allows you to pull his or her MVR.

- Establish driver eligibility guidelines and review MVRs regularly.

- Maintain hired and non-owned auto liability coverage for your company, which protects your company in a situation where your employee causes an accident while driving during company time.

Conclusion

A well-managed vehicle reimbursement or car allowance program will insulate your company from losses that are not the direct result of business operations, while at the same time offering nearly the same benefit to your employees as a company car. Ultimately, replacing a company car program will reduce the likelihood that an auto liability loss will damage your company’s insurability or increase insurance premiums.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.