Your home is a major investment, which is why it’s critical to protect that investment with the proper insurance. Homeowners insurance can offer financial protection in the event of an unexpected disaster or accident involving you, your home or your personal property. However, although it’s essential, homeowners insurance costs can pile on quickly.

To help you prepare accordingly, we will share a list of recent trends that are causing monthly premiums to increase and ways you can cut costs.

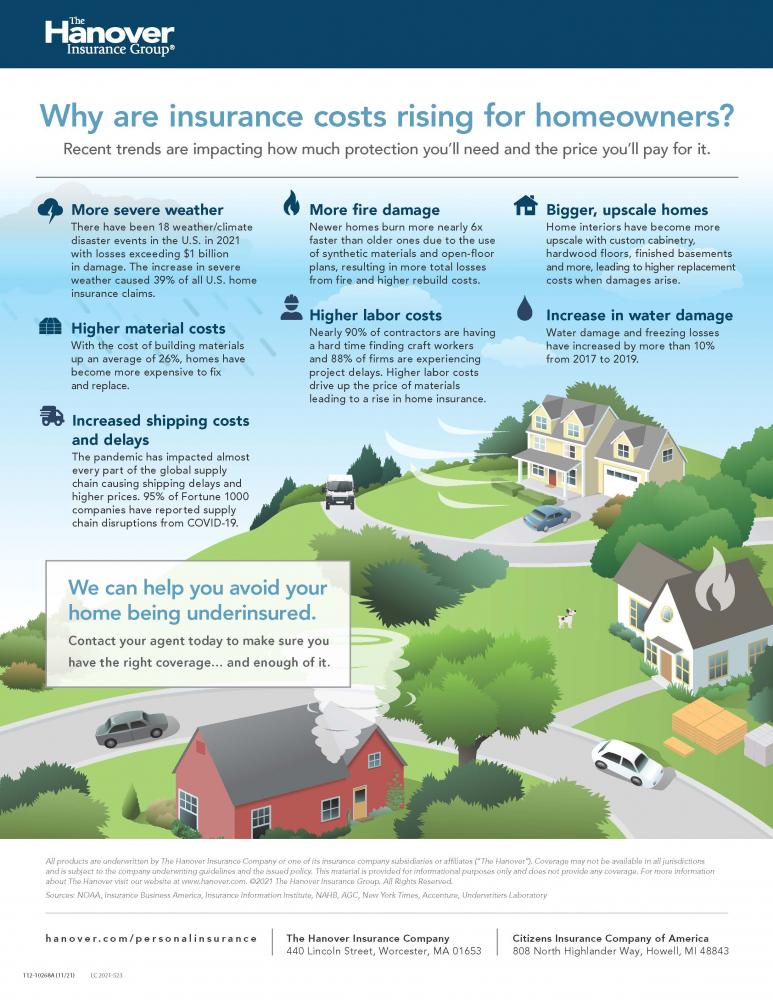

Why are insurance costs rising for homeowners?

These trends will impact how much protection you’ll need and the price you’ll pay for it:

- More severe weather: There have been 18 weather/climate disaster events in the U.S. in 2021, with losses exceeding $1 billion in damage. The increase in severe weather caused 39% of all U.S. home insurance claims. Damage caused by many disasters is covered in a standard homeowners insurance policy, but floods, earthquakes and other specific types of occurrences are generally excluded.

- Higher material costs: With the cost of building materials up an average of 26%, homes have become more expensive to fix and replace.

- Increased shipping costs and delays: The pandemic has impacted almost every part of the global supply chain, causing shipping delays and higher prices. 95% of Fortune 1000 companies have reported supply chain disruptions from COVID-19.

- More fire damage: Newer homes burn nearly six times faster than old ones due to the use of synthetic materials and open floor plans, resulting in more total losses from fire and higher rebuild costs.

- Higher labor costs: Nearly 90% of contractors are having a hard time finding craft workers, and 88% of firms are experiencing project delays. Higher labor costs drive up the price of materials, leading to a rise in home insurance.

- Bigger, upscale homes: Home interiors have become more upscale with custom cabinetry, hardwood floors, finished basements and more, leading to higher replacement costs when damages arise.

- Increase in water damage: Water damage and freezing losses have increased by more than 10% from 2017 to 2019.

How can you reduce homeowners insurance costs?

There are several measures you can take to help lower the price of your premium. Consider the following tips to cut costs on your homeowners insurance while remaining protected.

- Increase your credit score. You can do so by paying your bills on time and always paying at least the minimum payment due.

- Review your policy to determine exactly what it covers. Many policies cover replacement costs for repairing or replacing the damaged property using similar materials. A homeowners policy also covers your home’s contents, but coverage will vary based on your policy. Understanding what is and isn’t in your policy will help you plan accordingly, which can save you money if disaster strikes.

- Understand rebuilding costs. As a general rule, rebuilding a home will cost more than an identical newly constructed home. That’s because rebuilding includes a number of additional factors that can drive up the price of a rebuild, such as demolition, debris removal, worksite access and updated building codes. Don’t assume that the new construction cost of your home provides enough coverage – consult a contractor for an estimate on your home to prevent surprises down the line.

- Avoid filing nuisance claims. Use your coverage to protect against losses that you cannot recover by yourself. Take care of minor incidents on your own.

- Increase your deductible to lower your monthly premium. According to recent research from the Insurance Information Institute, increasing your deductible from $250 to $500 can cut costs by as much as 12%.

- Consider buying multiple lines of coverage from the same carrier. This practice can often lead to policy discounts. In fact, many carriers offer discounts for bundling homeowners and automobile insurance policies.

- Consult your insurance agent. In addition to these practices, be sure to reach out to your insurance agent for more tips on reducing your homeowners insurance expenses. Your insurance agent will be able to provide you with personalized guidance and cost-saving measures that are unique to your circumstances.

How do you ensure there are no gaps in your coverage?

It may be tempting to cut costs by reducing your homeowners insurance coverage to less than what you really need or eliminating your policy altogether. Doing so might seem like a simple way to save money in the short term, but it could easily lead to financial devastation later on in the event of a costly home disaster.

For additional homeowners insurance guidance, contact The Horton Group’s personal lines division to ensure you are fully protected with the right coverage.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.