By: Dan Galos, CWCA, AFIS, SBCS / Sales Executive

What is your insurance premium actually paying for?

Experience has shown that the absolute best way to uncover insurance premium savings while building a high-level risk management program is to work with a trusted broker. Find a partner that fits your needs and have them handle your insurance program from top to bottom, start to finish. As you develop a relationship, your broker should become an integral part of your business strategy as far as growth and cost savings.

Great brokers know your business at a very detailed level and are aware of all current operations as well as plans for future change and expansion. Your broker is a pivotal part of ensuring that your business continues to be successful. So it is essential to make sure you partner with someone that executes such year in-and-out.

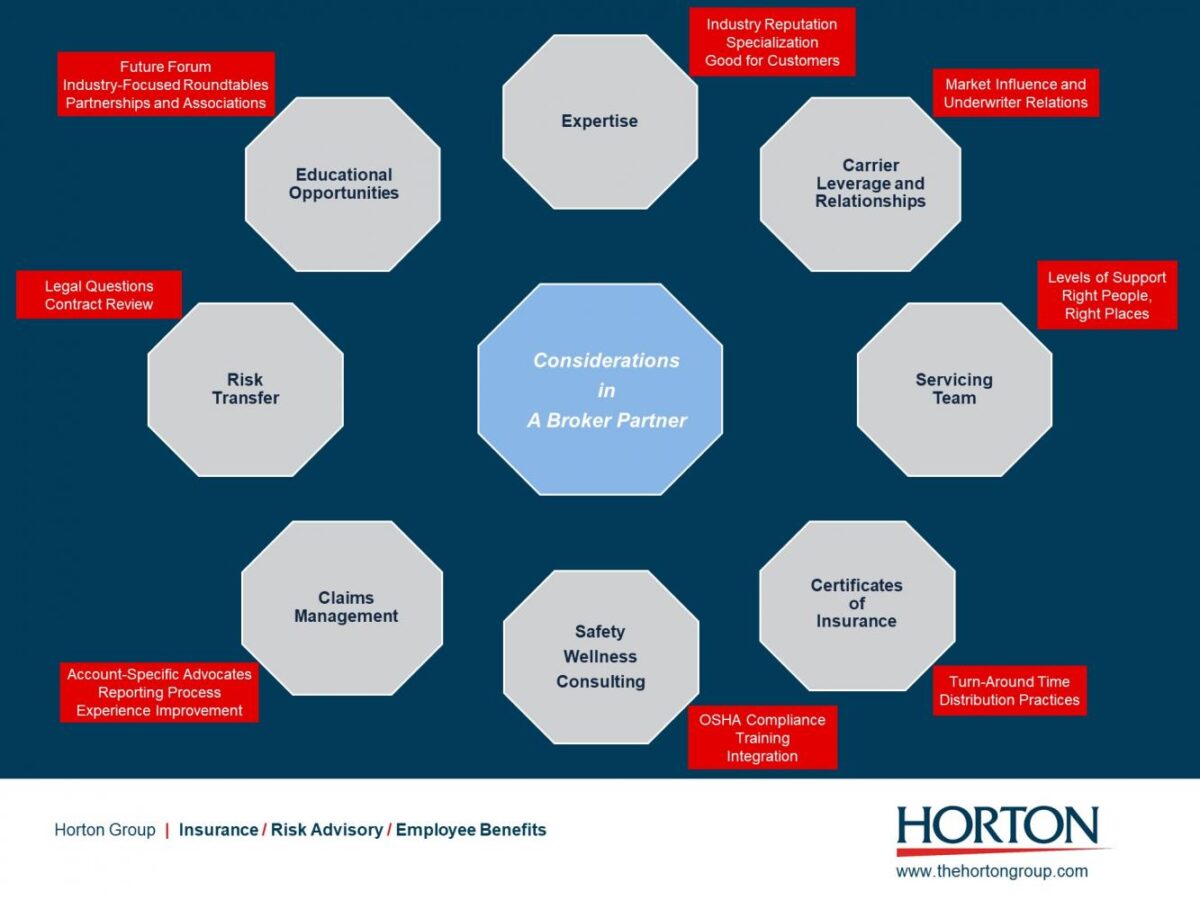

Beyond the quoting and renewal process, it’s important to evaluate the other services a broker has at its disposal for your business as well. While the renewal period is when you will have the most contact with each other, a broker should remain in contact and available throughout the year. This will ensure that you are being kept aware of changes or ongoing claims, as well as allowing you the peace of mind to run your business while leaving the insurance in their hands. Here is a list of aspects you should consider when interviewing a broker or considering a brokerage change:

- Level of expertise: How long have they been in the industry? How well do they know your type of business? What other clients do they have that can be used as references?

- Market share and Carrier partnerships: What’s the broker’s reputation in the marketplace? How much influence does the broker have when working with their underwriters and insurance companies?

- Team structure: Is there enough support to handle your needs? Will you have a specific person(s) assigned to work with your personnel (HR, Legal, Finance, C-Suite, Risk Managers, etc.)?

- Certificates of insurance: How long does it take to receive a certificate of insurance? What is the process of distributing these documents?

- Safety: What resources are available with the broker to help start or supplement a safety program? How can they help you when dealing with OSHA? What is the process for dealing with a new hire and safety training? How does the broker help to reduce your Experience Mod through safety?

- Claims: Is there an in-house claims team? Will you have a specific claim advocate assigned to work with your company? What is the process when dealing with a new claim? How does the broker help to reduce your Experience Mod through claim advocacy?

- Legal services/Contract review: Does the potential broker have the means to assist with legal questions concerning the insurance policy or contracts you must sign for clients/customers?

- Educational opportunities: What kinds of seminars, presentations, or networking events does the broker host to help improve your business? What partnerships does the broker have with industry or community associations that are important to you?

Take the time to interview your broker like you would interview a new employee. It’s important to understand everything a broker has to offer both during the renewal period and throughout the year. Changing from a “non-stop quoting mentality” will be very beneficial in both the short and long term. Imagine how much time and effort you could save yourself by not having to go through an entire quoting process every year with multiple brokers. As a business owner, you wear many hats. Let your broker wear the Insurance hat for you and get back to focusing your energy on running your business.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.