This article will help you understand what negligent entrustment is, the risks it poses for commercial fleets, the proper steps to take for any business, and the commercial auto insurance market outlook.

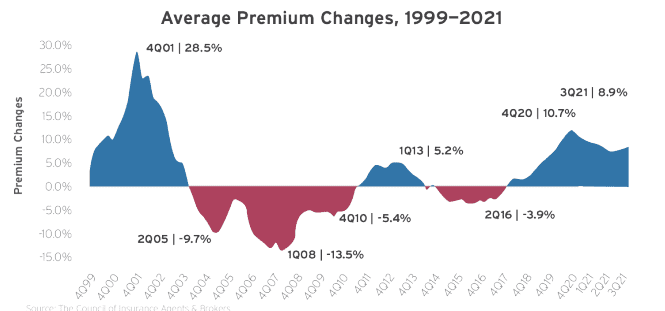

Like many other sectors of the economy, the commercial insurance industry is experiencing changes to both its market cycles. We can see above that the average premium changes have drastically shifted to increases for many employers.

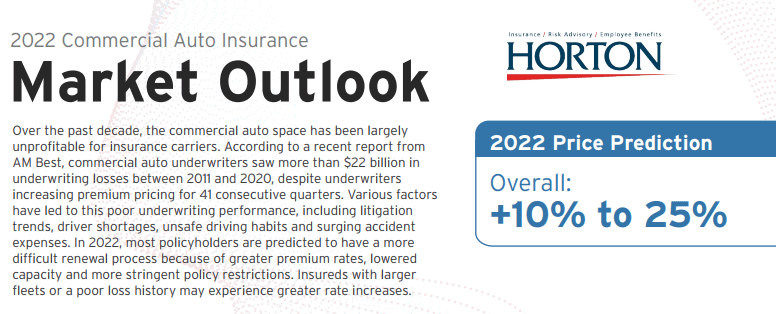

To avoid a drastic increase in commercial auto premiums of 10% to 25% as seen by the price prediction below, it’s important to be proactive in implementing policies and procedures while avoiding the biggest tort law pitfall of negligent entrustment that leads to the big nuclear verdicts against companies.

2

We can see the overall price prediction for Commercial Auto insurance premiums in 2022 is an average increase of 10% to 25%. This can be a substantial increase for companies with large fleets and even larger for companies with bad loss histories (click image for download).

What is negligent entrustment?

“Negligent entrustment” is a legal term defined as “the entrusting of a dangerous article (such as a motor vehicle) to one who is reckless or too inexperienced or incompetent to use it safely.” 3

In connection to a commercial fleet, negligent entrustment takes place when you allow “someone” to use a company vehicle while knowing that the new employee is not qualified or had a previous driving record that should disqualify them from driving. “Someone” could include employee, contractor, third-party service provider, family member, etc. depending on variables. This results in vicarious liability by the employer.

For employers, this means that vehicle telematics data, driver qualification records, and human resources policies and procedures will be discoverable in the event of an accident.

When is a company liable for negligent entrustment?

A company may be held liable if: 4

- The company has policies that state that MVR’s (motor vehicle records) will be reviewed against set criteria, drivers failing to meet the criteria will be disqualified, AND drivers continue to drive for the company even though they fail to meet the criteria.

- The driver was negligent due to the use of a suspended license and the company knows or should have known that the license was suspended.

- The company has been receiving telematics data that shows negligent activity on the part of its drivers and has not acted on it.

What types of employers and employees are most likely to be at risk for a negligent entrustment claim?

The construction, manufacturing, and trucking industries immediately come to mind for running the risk of being held liable for negligence. For example, a construction company might not properly screen a new employee, missing consistent driving record infractions before hiring. Suppose that employee subsequently causes harm to a third party while operating a company vehicle and the employer or company owner knew they did not properly screen that employee during onboarding. In that case, this could result in a negligent entrustment ruling against the company. Any business that has a big commercial fleet is at risk.

Loss Control – How can a company mitigate potential losses?

1) Document and verify that policies and procedures are followed while operating.

This is where an insurance broker can help put together an entire true fleet safety program. When submitting to an insurance carrier they’ll ask for safety policies. They want to see what policies and procedures are in place to ensure that they’re being implemented in the company.

- The problem often lies in the fact that around 50% of companies find safety program documentation online, send it to insurance companies, and don’t know how to implement it in their day-to-day operations.

An insurance broker can assist in this situation by sending a commercial driving safety guide to the company that they put together, which typically includes:

- Information on key factors to consider from a fleet safety standpoint.

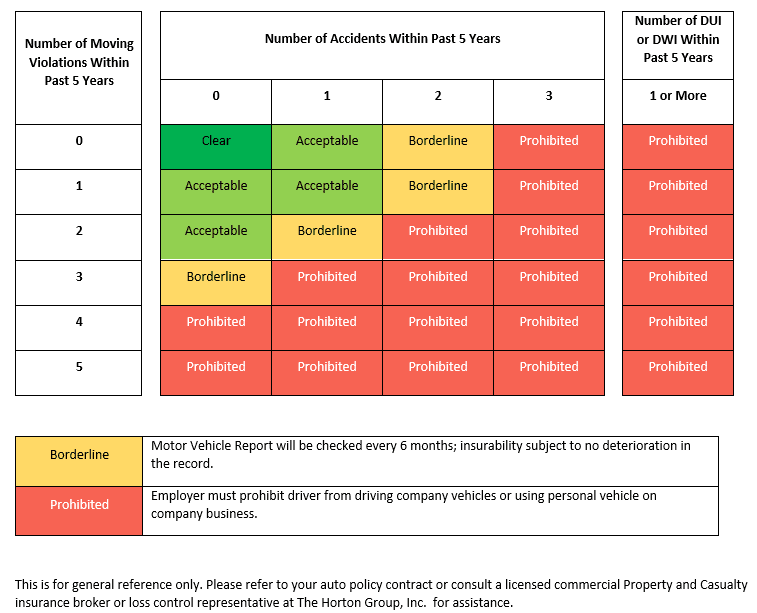

- Various forms that can be used including a distracted driver policy, vehicle inspection report form, motor vehicle accident reporting form, inspector qualification form, driver warning notice, fleet safety policy, and a driver acceptability matrix.

Company safety manuals should not be collecting dust as most so often do. By implementing this safety manual into day-to-day policies and procedures and educating the management and employees through toolbox talks, the company can be better prepared to mitigate the safety risks of its operations.

5

(Click image for download)

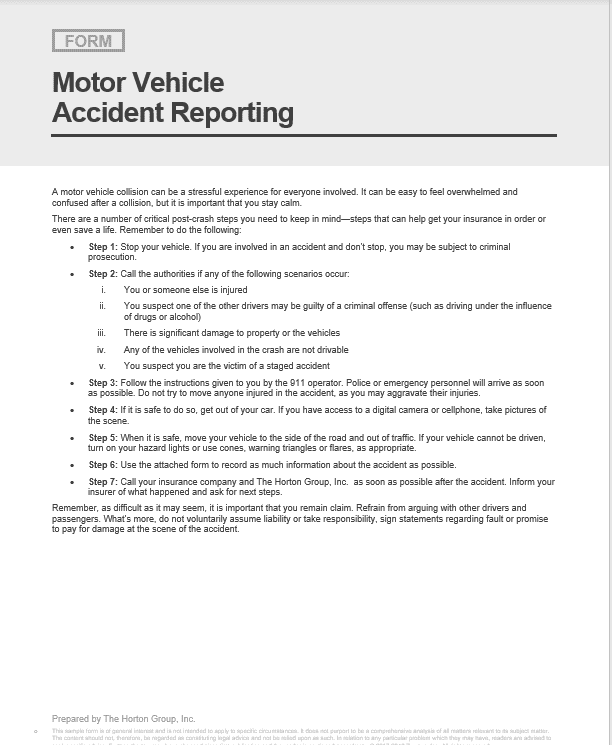

Without hesitation, an employee should have a motor vehicle accident reporting form sitting in their glove compartment at the ready. Documenting accidents and knowing the immediate steps to take will reduce the company’s workload in having to find out exactly what happened from the employee’s standpoint. This will also give the company a shot at fighting the costs of this accident with the insurers.

6

(Click image for download)

For driving infractions by employees, if there are multiple instances of speeding by an employee that the company is aware of because they use a fleet telematics program, the implementation and documentation of driver warning notices are important:

- Give the employee a driver warning notice outlining what happened. Have them sign it.

- Place the signed driver warning notice on the file of the employee.

2) Proactively address key issues prior to hiring a new employee.

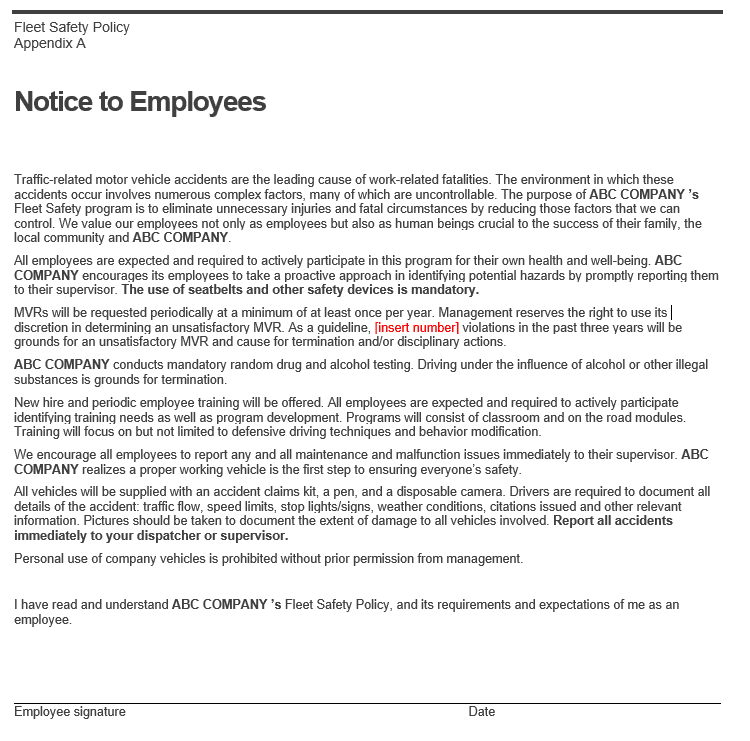

Develop a fleet safety program that allows the company to proactively screen employees prior to being hired. To show that a company is serious about its commercial fleets safety, policies must be in place even before the hiring of a new employee, with signed documentation regarding various licenses needed, both on a state and federal level. New drivers should also be required to review and sign off on various policies and procedures including:

- Distracted Driving

- Applicant Safety Performance History

- Fleet Safety

- The Company Pledge

All of these have a common theme – they must be signed by the employee.

7

(Click image for download)

3) Prioritize ongoing safety education for employees.

There should be an importance placed on toolbox talks for ongoing education of safe driving with employees, including:

- The importance of defensive driving

- Avoiding fatigue

- Driver training

Insurance carriers can provide toolbox talk examples, and they can also conduct a loss control visit onsite.

At the least, it is key to conduct annual toolbox talks and keep it top of mind for employees to ensure that they’re not getting complacent. The worst thing that can happen is a company gets complacent, an accident occurs causing personal injury to a third party, and the company is left unprepared and liable for negligently entrusting a motor vehicle.

How often should ongoing education of employees in the fleet safety program occur?

Best in class businesses will educate their employees on a daily to weekly basis. Smaller organizations might move to a monthly or quarterly basis. However, running quarterly fleet safety program educational sessions runs the risk of becoming too relaxed and complacent. Employee engagement with these educational sessions ultimately comes down to the presenter and how they can make it fun.

Employees often pass background checks but then have strikes on their record that go unnoticed after employment.

This is not uncommon. Typically, companies will like to reach out to their broker, hoping to add a driver to their policy and asking if they can see if the potential employee has an acceptable driving record. This usually means that the employer did not pull the MVR. They subsequently hope the broker will pull the background or hope the carrier will simply accept or reject the driver. The problem with this approach is the employer is not being proactive. Instead, they should show insurance companies that they have an active fleet safety program with signed documents from employees instead of a passive program. This will not only help companies fight off negligent entrustment cases but will also help keep insurance premiums drastically lower.

Key Developments and Trends to Watch For

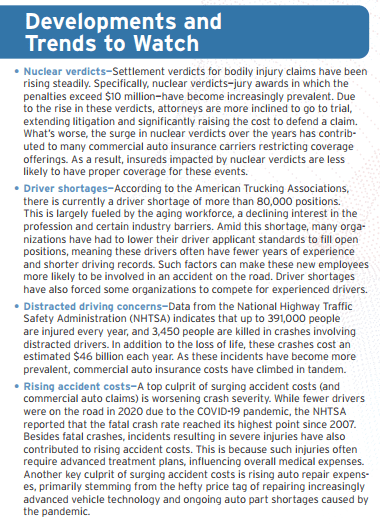

8

(Click image for download)

The top four developments and trends to watch for include:

- Nuclear verdicts

- Driver shortages

- Distracted driving concerns, and

- Rising accident costs.

Attorneys are now more inclined to go to trial and extend litigation. This results in commercial auto insurance carriers restricting coverage offerings for fear of millions of dollars needed to cover penalties to insureds. If a company with a commercial fleet is entrusting a vehicle to a driver, there is a 100% chance that there’s negligent entrustment exposure sitting there.

Commercial Driver’s License Age Revisions

A bill recently signed by the U.S. Congress now lowers the age of drivers with a commercial driver’s license (CDL) permitted to operate commercial vehicles across state lines. The provision lowers the age for interstate drivers from 21 to 18. “People as young as 18 will soon be allowed to drive commercial trucks carrying tons of cargo across state lines under a federal apprenticeship pilot program that is intended to train thousands of new drivers. 9 This will continue to force businesses to be strict about their proactive screening and commercial fleet safety program. Being aware of negligent entrustment is the first step in being prepared to fight off a nuclear verdict. Having the proper safety programs in place will help avoid mitigate the risks of incidents and prepare companies in the case of an accident.

Businesses must adapt to changing cultural attitudes about fault.

Are you interested in learning more about how The Horton Group can help you take proactive safety measures for your commercial auto needs? Schedule time on Dan Leja’s calendar here.

References:

- Zywave, 2021. P&C Market Outlook 2022. [online] p.4. [Accessed 17 January 2022].

- Zywave, 2022. 2022 Commercial Auto Insurance Market Outlook. [online] [Accessed 17 January 2022].

- Merriam-Webster. 2022. Negligent Entrustment. [online] Available at: <https://www.merriam-webster.com/legal/negligent%20entrustment> [Accessed 17 January 2022].

- The Zurich Services Corporation, 2018. Risk Topics. Negligent Entrustment. [online] Available at: <https://www.zurichna.com/-/media/project/zwp/zna/docs/kh/prog/negligent_entrustment_rt.pdf?la=en&hash=6AEB8D3C7052857F8AFD394319F3D176> [Accessed 17 January 2022].

- Zywave, 2022. Commercial Driving Safety Guide. [online] p.56. [Accessed 17 January 2022].

- Zywave, 2022. Commercial Driving Safety Guide. [online] p.32-37. [Accessed 17 January 2022].

- Zywave, 2022. Commercial Driving Safety Guide. [online] p.47. [Accessed 17 January 2022].

- Zywave, 2022. 2022 Commercial Auto Insurance Market Outlook. [online] [Accessed 17 January 2022].

- Chung, C., 2022. Facing a Shortage of Truck Drivers, Pilot Program Turns to Teenagers. New York Times, [online] Available at: <https://www.nytimes.com/2022/01/19/business/apprentice-program-truck-drivers.html> [Accessed 21 January 2022].

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.