Republished with permission from Prairie Capital Advisors

The U.S. economy showed resilience in 2022 but this is a challenging time. At the beginning of the year, consumers with liquid resources and good jobs as well as businesses with adequate funding, provided a base for strong 2022 economic activity. However, 2022 also saw a Russian invasion of Ukraine, disruptions in the global energy markets, continued supply chain problems and big declines in the public equity markets all of which sapped the base strength of the economy.

Additionally, high inflation and the Fed’s inflation fighting interest rate increases have further eroded consumer and business owner sentiment. While consumer sentiment improved a little in January 2023, it remains well below the post pandemic high recorded in 2021. The business malaise continues as well. The NFIB Small Business Optimism Index declined in December, marking the 12th straight month of below average index performance.

Overall Review

So, what does that suggest for 2023? In the January 10, 2023 report, the Conference Board Economic Forecast stated “Economic weakness will intensify and spread more widely throughout the U.S. economy over the coming months, leading to a recession starting in early 2023. The outlook is associated with persistent inflation and the Federal Reserve becoming more hawkish. We forecast that real GDP growth will be 2.0 percent in year-over-year in 2022, slow to 0.2 percent in 2023, and then rebound to 1.7 percent in 2024.” Specifically, the Conference Board is calling for negative quarterly GDP growth in the first 3 quarters of 2023 and returning to growth late in 2023. Clearly this next calendar year will be interesting for the economy and the deal business.

M&A market activity, both in number of transactions and in dollar value, steadily declined during 2022. While comparisons to the record M&A volumes of 2021 is unfair, 2022 will likely produce deal activity far below the levels achieved in 2021 and more on par with the pandemic shutdown year of 2020. The rapid emergence of inflation and the delayed recognition of the depth and breadth of the problem has negatively impacted the economy and M&A. Inflation is an insidious economic problem that has not been seen for decades. Both monetary and fiscal policy errors contributed to the inflation problem and will make eradicating inflation a more protracted exercise.

Even with these negative issues, there is still room for optimism in the M&A market. The market is almost always receptive to quality deals. However, we believe the broad based “sellers’ market” experienced before, and shortly after the pandemic has reached an end. The market has bifurcated with well-prepared, relatively strong companies commanding broad buyer interest, but lesser quality sellers seeing less interest and lower valuations. We have now entered a “flight to quality market” where buyers are attracted to the best companies. Sellers with strong businesses and good operating performance should still see broad buyer interest.

Further adding to our optimism, the private equity (“PE”) buyer community always needs to deploy abundant, time limited, investment capital. However, because of a more conservative lending environment, large bank loan syndications and debt offerings are more difficult to accomplish. As a result, larger deals and platform acquisitions will be less attractive to the PEs in this market. Middle-market companies that can be pursued as “add-ons” to PE portfolio companies will see PE interest. These deals are smaller, easier to finance with single bank credit facilities avoiding the syndication market.

Furthermore, smaller deals that are easier to finance can also be platform build-up acquisitions. PEs will be less aggressive on larger deals but will find ways to put their committed capital to work.

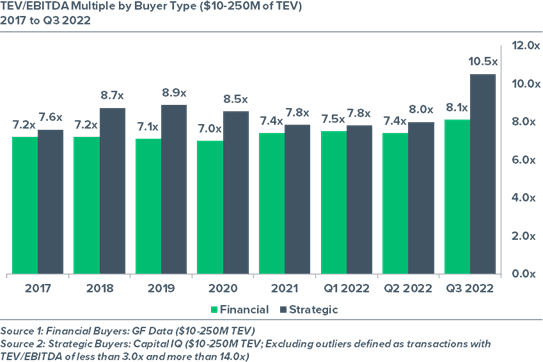

Our recent market data shows the reemergence of the aggressive strategic buyer. Over the last 18 months, we have observed that PEs and strategic acquirors have paid almost equal prices for deals eliminating the strategic premium of the pre-pandemic years. Strategic buyers have historically paid more for acquisitions because they could exploit revenue and cost synergies by making acquisitions. We believe they reduced their pricing due to labor and supply chain issues that complicated exploiting these synergies. Our late 2022 data shows that situation has begun to change with strategic acquirors returning to their more aggressive acquisition behavior.

In this market, sellers really need to think like a buyer and position their companies in a sale process to match the buyer’s acquisition objectives. Sellers should have a sound understanding of the value drivers in their business and develop and understand how their Company fits with potential buyers. Preparation is key. Having a clearly articulated investment thesis and well-constructed descriptive offering materials will be critical in this market. Sellers should have well- supported historical financial information and a detailed business plan describing the acquisition opportunity and how the potential company risks can be mitigated. Sellers should be prepared for deeper, more lengthy due diligence processes. This is not the time to attempt to sell your Company on your own. A good advisory team, including an experienced investment banker will be critical to your success. Company owners with a strong desire for a liquidity event and good performance should begin to consider their strategic alternatives immediately and make plans to enter the market as soon as possible.

Due to the extended period that private company M&A market data are collected, there is a one-quarter lag in our information. As a result, the market commentary reflected below is limited to the data through 3Q22. 4Q22 data is still preliminary and will be reviewed in detail next quarter.

M&A Market Activity

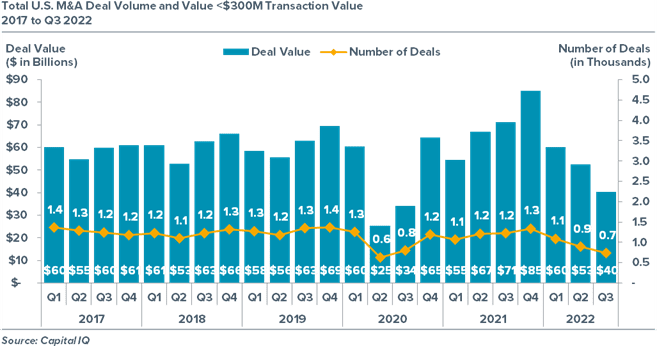

Deal activity has fallen precipitously after the record M&A year of 2021. Remember, 2021 was a unique year where the 2020 pandemic shutdown created a backlog of M&A deals that were completed in 2021 and expected potential tax law changes served to further stimulate new deal activity. No matter how you look at the data, 2021 was a tough act to follow.

Through the first three quarters of 2022, the number of deals recorded was far below the first three quarters of 2021 and about equal to the number of deals during the first three quarters of the pandemic affected year 2020. Persistent inflation, escalating interest rates and increased uncertainty has caused negative business sentiment and less buyer risk appetite. This negativity has dramatically influenced downward the 2022 volume of deal activity. Our preliminary 4Q22 data shows a further decline in both deal value and deal volume. The sheer number and magnitude of domestic economic problems has begun to weigh heavily on the M&A market this year.

- $40 billion of middle-market deals were recorded in 3Q22, down 24.5% from the value in 2Q22 and, in year-over-year comparisons, 3Q22 deal value was down 43.7% compared to 3Q21. Deal value in the three quarters of 2022 was 20.7% lower than the tally in the first three quarters of 2021.

- The number of middle-market deals closed in 3Q22 was down 22.2% from the number of deals closed in 2Q22. In year-over-year comparisons, the number of deals in 3Q22 was 41.7% lower than the number of deals in 3Q21. The number of deals in the three quarters of 2022 was 22.9% lower than the number of deals in the first three quarters of 2021.

- The average middle-market deal size of $57.1 million in 3Q22 was slightly smaller than the average $58.9 million deal size closed in 2Q22. The average deal size of $56.7 for the first three quarters of 2022 was 2.8% higher than the average deal in the first three quarters of 2021.

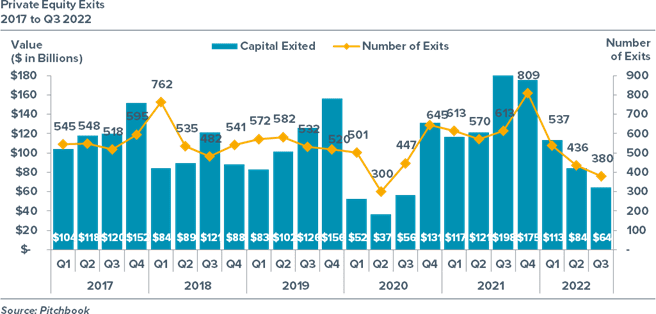

Similarly, PE exit activity slowed in 2022 compared to the record levels achieved in 2021. The number of PE exits in 3Q22 decreased 12.8% from the number of exits in 2Q22, while the capital exited decreased about 23.8% during the same period. Like the overall M&A market data, our preliminary 4Q22 PE exit data shows a continuation of this declining trend through the end of 2022.

Relatively high inflation and elevated interest rates have started to have a negative impact on the M&A market. The M&A deal market remains strong for higher quality companies that will continue to attract strong market attention and higher valuations. In contrast, lesser quality deals still attract attention but at lower valuations. Both strategic and financial buyers continue to actively participate in the M&A market, but financing is starting to be an issue for larger PE deals. In this type of deal environment, seller preparation is essential. Sellers and their advisors need to develop a compelling investment thesis and a well-thought-out company positioning strategy to complete a successful sale. Sellers prepared to handle the challenges of a more arduous M&A process can still attract buyers and achieve strong enterprise valuations.

Middle Market Deal Valuations

The supply-demand imbalance in middle-market deal activity, fueled by abundant PE fund capital and well-capitalized strategic acquirors, has helped sustain higher deal valuations. However, inflation, increased interest rates and lingering supply chain and labor issues experienced in 2022 have changed the dynamic. Increased business risks have muted the acquisition appetite of PEs and strategics reducing the demand side of the equation. Further these same risks have diminished the number of sellers as they pause and consider waiting for a better market. It is still early but our data is beginning to show a pullback in M&A valuations. A “sellers’ market” may still exist for well-prepared quality companies, but this same market interest does not extend to poorer quality, unprepared companies.

Inflation appears to be waning somewhat due to declines in commodity prices and energy costs. However, overall inflation is a persistent issue and is declining far slower than expected. Increased labor costs, rising food prices and higher shelter costs suggests a broad-based, imbedded inflation that will be harder to eradicate. As a result, it is expected that the Fed will have to continue rate increases well into 2023 and maintain higher interest rates through 2024. The interest rate increases in 2022 have moved interest rates to a 15 year high. This has caused more expensive debt financing, greater debt service costs and more conservative financing parameters.

Financing is a becoming a limiting issue in larger M&A transactions, particularly with bigger PE deals. Higher financing costs and more difficult debt underwritings makes obtaining capital harder for larger deals. Strategic acquirors are less reliant on deal financing and have not faced the same challenges as the PEs. We believe the current M&A market “sweet spot” are with deals between $10 and $50 million in value where financing is easier to attract. In this size category, both PEs and strategics are aggressively competing and as a result, valuations remain high.

In previous newsletters, we noted that strategic acquirors have pulled back in their purchase price offers. Now it appears the PEs financing impediments coupled with more aggressive strategic buyers have changed the dynamic. The valuation differential, “strategic premium,” between PEs and strategic buyers is starting to rise again. We expect that the strategic premium will return to levels observed before the pandemic.

As described earlier, the sub $50 million 3Q22 M&A market segment data show a continuation of the high valuation trends observed in the pre-pandemic years of 2017 and 2018. The strong demand by acquirors and the financing available helps support these lower segment market valuations. But preliminary 3Q22 data shows the beginning of a decline in valuations for the larger deals.

- 3Q22 deal valuation multiples for the sub-$25 million category came in at 7.4x, well above the long-run average of 1.0x for this size category.

- Larger middle-market valuations ($50 to $100 million segment) in 3Q22 moved down to 8.6x perhaps reflecting the financing issues with larger deals described earlier.

- Valuations in the $25 to $50 million segment moved higher at the 7.8x level, which is significantly higher than the five- year average of 6.9x.

Private Equity versus Strategic Valuations

Corporate and PE strategic buyers have been very active in the 2022 M&A market and still make up more than 70.0% of all the buyers. Synergistic cost savings, access to new customers and other revenue opportunities provide strategic buyers with the ability, but not the need, to pay more than the typical financial buyer. As we noted in our previous newsletters, since the end of the pandemic, the strategic buyer acquisition behavior has been more conservative, and they have generally not paid up for acquisitions. A combination of more aggressive strategic buyers and financing difficulties has reduced the aggressiveness of PE buyers and re-established the “strategic premium” that existed prior to 2021.

- Strategic buyers are always active participants in middle- market M&A. In 2021, strategic buyers paid only a slightly higher multiple of cash flow than PEs well below the pre- pandemic years. However, our 3Q22 quarterly data indicate the strategic buyers have returned to pre- pandemic form and are paying more for acquisitions.

- Over the last five years, EBITDA multiples paid by PE buyers have remained in a range centered around 7.2x. The valuation data through 3Q22 indicate PEs are currently paying slightly above trend for new deals.

- Historical valuation data suggest that in the M&A market, strategic buyers tend to pay a premium of about 1.5x when compared to PE firms. Our 3022 data suggest a return to that trend.

- Prairie estimates that, for deals below $50 million, middle- market valuations are generally one to two multiples of EBITDA lower than the levels reflected in the chart below.

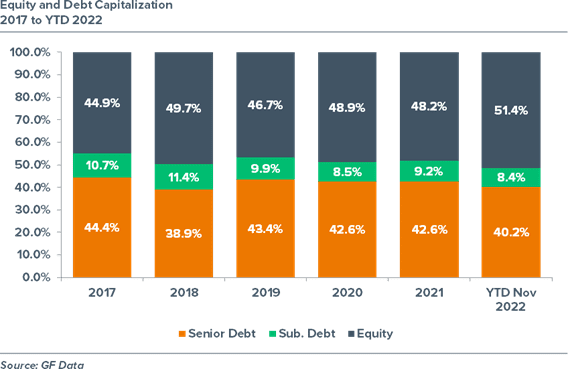

Middle Market Leveraged Buy Out Capitalizations

Middle-market company capitalizations have become more conservative as inflation, higher interest rates and the risks of a recession have become bigger concerns. Credit is becoming harder to obtain as banks and other lenders have tightened their credit parameters. According to the third quarter 2022 Fed Senior Loan Officer survey, almost 40.0% of commercial banks are tightening credit standards. As a result, senior debt is becoming a smaller component of a typical leveraged deal capital structure. Business development corporations (“BDCs”) and mezzanine lenders have bridged the gap in loan availability but even these capital sources are reducing their holds, increasing their interest rates and requiring more lender friendly terms.

- Loan availability is somewhat reduced in the current market and terms are more conservative than before the pandemic. Deals are seeing less financial leverage, higher interest rates and more lender-friendly terms, reflecting overall increased business risks in the current environment. Currently, debt makes up less than 50.0% of a capital structure.

- BDCs have been a strong participant in the deal market, especially for larger deals. But even they are currently less aggressive in pursuing new lending opportunities. Further, BDCs have higher interest rates and more lender friendly structures making debt costs higher.

- Mezzanine funds are active in leveraged transactions. This capital has a high interest rate that can stress a company’s cash flows but continues to be a critical component of a middle-market buyout capital structure when senior debt capital is harder to find. Interest-only and payment-in-kind (“PIK”) structures still dominate the markets, but in the current environment, the use of equity co-investment structures help match mezzanine returns with deal risk profile.

Overall Comment on the Financing Markets

It seems like ancient history now, but it is worth remembering. After the Great Recession in 2009, the Fed began an extended period of near zero interest rates and a policy of buying financial assets to keep asset prices low to continue the economic recovery. These moves set the stage for a long period of economic growth and very strong equity and deal markets through the end of 2021. Even with the Pandemic induced major equity market sell off and a quick recovery, this was an unprecedented period of financial asset growth. However, the sudden economic “stop” induced by the pandemic coupled with a very dramatic post pandemic economic recovery also totally changed the demand supply dynamic in the economy.

Once the economy was “re-opened” there was an enormous miss match between pent-up consumer and business demand and the manufacturing and service sector’s ability to ramp up capacity to satisfy that demand. Demand exceeded supply and the prices of all goods and services were “bid up” rapidly, setting off massive inflationary pressures. While well-meaning, the federal government made the situation worse by supplying several massive waves of federal government support leading to even more demand stimulus and a further escalation of inflation.

Once it starts, inflation is not easily eliminated. An economic slow down is generally required to reduce aggregate demand in the economy and bring demand in line with supply. Slowing the economy where consumers and businesses have resources generated in the recent bull market, massive amounts of federal stimulus money and where labor is still in short supply (i.e., everybody has a job) is not an easy task. Like the Fed Chairman Alan Greenspan did in December 1996 when he took away the “punch bowl” to quell what he characterized as “irrational exuberance,” the current Fed Chairman, Jerome Powell is using increased interest rates to rapidly slow the economy and negatively impact the labor markets. But interest rate increases are not a precise tool.

Further measuring the effects of the increases can be difficult and the lag in the effects of rate increases is also difficult to determine. The Fed could overshoot the target and cause a deep recession or undershoot the target and risk an extended period of stagflation. The former situation will break inflation at a great cost and the latter situation will be even worse because we will still have high inflation and no economic growth. Fed Chairman Powell is trying to end up somewhere in the middle and deliver the legendary “soft landing.”

The financing markets are reflecting Powell’s strategy and recognizing the implicit risks. Interest rates have increased which makes credit more expensive to borrowers. Higher interest rates are a greater burden on borrowers and that greater burden makes deals riskier. As a result, banks and other lenders have become more conservative in their underwriting standards reducing the availability of credit. The Fed’s rate increases has begun to reduce the amount lending of all types.

Furthermore, higher interest rates have made the public stock and bond markets less attractive to new issues. According to Ernst & Young, the number of IPOs in the U.S. was down 76.0% from 2021 and the IPO proceeds raised was down 95.0% over the same period. New high yield bond issuance (a proxy for leveraged lending) in 2022 was at its lowest dollar levels since 2008 and down 78.0% from the 2021. Like the increased costs of other debt financing, the yield on these riskier bonds crossed into double-digit territory in late 2022.

Clearly the interest rate increases have started to slow the financing markets and the economy. That is the Fed strategy, but the mission is a long way from being accomplished. Further rate increases are expected in 2023 with the potential, only the potential, that the rate increases will be smaller and less frequent than in 2022.

Financing will be more expensive in 2023 and M&A valuations could be negatively impacted. However, financing deals will still be done. Preparation is key in this market. All borrowers should have documented business contingency plans that show lenders how the company will react to higher interest rates, lower margins, changes to revenues and other business calamities. Lenders want to be repaid and so borrowers must detail how they will make that happen. With proper preparation, good quality, credit-worthy issuers should be able to attract capital. Borrowers will have to be prepared for a longer financing process and potentially more conservative and expensive capital structures.

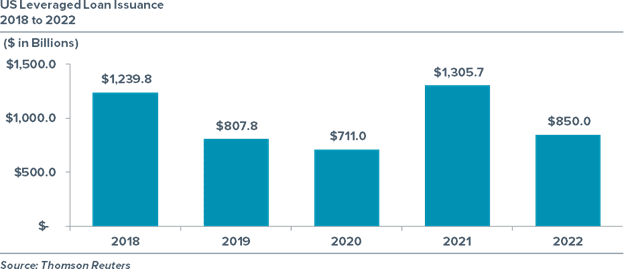

Total U.S. Leveraged Loan Issuance

- U.S. Leveraged Loan issuance in 2022 at $850 billion dropped about 35.0% from the record volume of $1.31 trillion recorded in 2021. The increase in 2021 new commercial and industrial (“C&I”) loan issuance reflects a robust economic recovery and the record 2021 M&A market. However, like the M&A market, 3Q22 loan volume was lower than 3Q21, reflecting the drop in 2022 deal volume and greater economic uncertainty felt by business owners.

- The Fed took the necessary steps to support banks and maintain sufficient liquidity in the banking system during the pandemic. That strategy succeeded resulting in abundant liquidity for loans in the banking system. However, the current business environment uncertainty has made lenders far more cautious and reduced their appetite for leveraged loans.

- Bank lenders continued to focus on relationship banking, corporate borrowers’ lines of credit and areas where they have a competitive advantage, such as operating business needs (including payroll and checking accounts). Due to the current economic environment, banks are cautious in making new loans and are very selective in new leveraged transactions. BDCs and other lenders have taken up the slack but even this sector is less aggressive than previously.

Interest Rate Environment

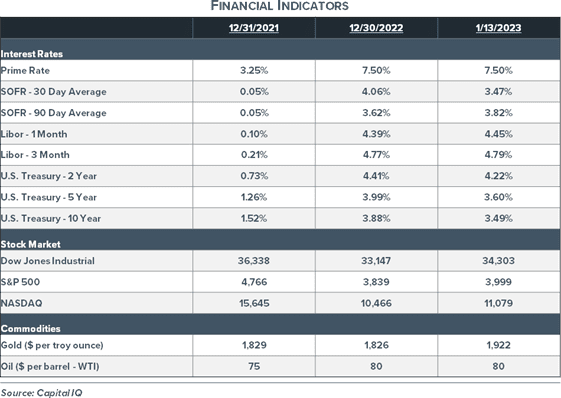

The Fed began raising interest rates in March 2022 once it was finally recognized that inflation was a larger issue and more significant than originally thought. During 2022, the Fed made seven increases to the Fed Funds Rate putting that benchmark rate, at 4.25-4.50%, the highest level in 15 years. According to Fed Chair Powell, the Fed does not intend to lose the inflation battle and he indicated that rate increases will continue into 2023 until the Fed is convinced that inflation is under control.

As a result of the Fed interest rate increases, the Prime Rate was increased by 425 basis points and the yield curve shifted higher and has become inverted. The slope of the yield curve at the end of 2021 was upward sloping, reflecting increasing but, at that time, relatively normal inflation expectations. The 2-year to 10-year Treasury differential was 79 basis points at the end of 2021. At the end of 2022, because of the Fed’s unusual manipulations of the short-term Fed Funds Rate, that differential was shifted to a negative 53 basis points, resulting in an inverted yield curve. While not perfect, an inverted yield curve is a somewhat reliable predictor of a recession in the future.

For many reasons, the probability of a recession has increased dramatically. According to Bloomberg, in a late December 2022 poll of 38 economists, there is a seven in 10 chance of a recession in the next 12 months. The debate seems to center on the depth of the recession, whether it will be mild or something more severe and economically damaging. Time will tell.

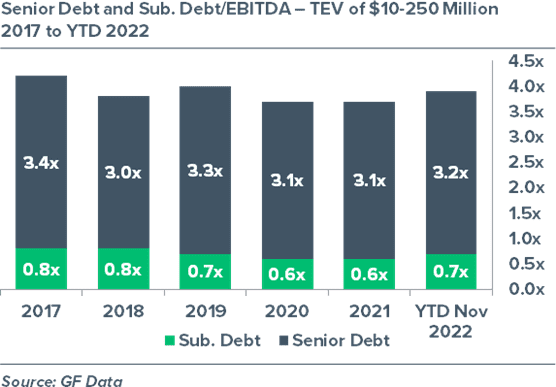

Middle Market Debt Multiples

- Average total debt leverage in middle-market deals declined to 3.7x in 2021, down from the 4.0x average in the pre-2020 time. Total leverage moved up slightly in 2Q22 which may be due to volatility in the quarterly information.

- Mezzanine capital played an important role in a leveraged capital structure in the pandemic environment. While mezzanine is more expensive capital than senior debt, its return structure matches the risk profile of companies operating in the post-pandemic period better than a similar amount of equity.

- Over the past five years (2017-2021), mezzanine debt averaged about 0.8x EBITDA in the typical capital structure. In 2019, banks and BDC lenders started to disintermediate the mezzanine capital as they searched for new lending opportunities. Beginning in 2020 and continuing through 2021, with an increasingly conservative bank lending environment mezzanine capital is becoming a more significant component of the typical capital structure.

- The Fed interest rate increases during 2022 has already started to affect the amount of senior debt in the typical capital structure.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.