By: Tony Hopkins, CPCU, CIC, CRM; Senior Vice President, Business Insurance

key concepts

- Two Emerging Trends – Cyber and Transactional Insurance

- Three Tried & True Tips on Roll-Up Due Diligence

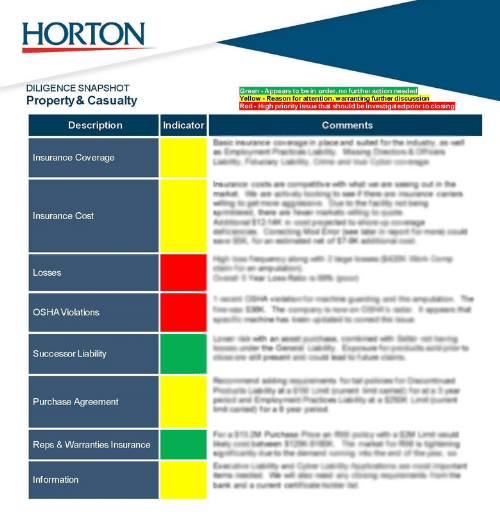

Here are the biggest buy-side considerations for Property and Casualty insurance as you step through the roll up due diligence process.

NOTE: Despite being in the profession of selling insurance, we try to take a more pragmatic approach to purchasing insurance. Just because insurance is available doesn’t mean that you should buy it. For every situation, there are different needs, risks and risk tolerances of the parties involved. Please note that many of these tips are “considerations” and aren’t just blanket recommendations.

emerging trend: Cyber insurance

Cyber insurance is certainly not a new concept, but the market for this is crazier and more fast-paced than ever. Here are two tips to keep in mind:

- Start the cyber diligence process early. It’s no secret that the cyber insurance market has reached a pivot point. Coverage used to be inexpensive and easy to get, with little underwriting. With increased cyberattacks (particularly ransomware), the insurance carriers are underwriting more extensively and charging more.

During a roll up, the entities brought together often remain on their own operating systems, continuing to use some of the same programs they had been using prior to close. In the new cyber world, it is much more difficult to implement proper controls amongst various systems.

Ideally, a platform company would purchase one Cyber insurance policy, and the acquisitions made throughout the policy would be automatically included. Depending on the controls and loss experience, one policy might not be possible, triggering the need to place multiple policies for each new entity. There is no guarantee that cyber coverage will be available in this market (especially if Multi-Factor Authentication is not in place and there has been a recent breach), leaving a company exposed to one of the biggest risks executives cite today.

- Introduce your Property & Casualty insurance providers to your Cybersecurity team.

Cyber used to be one of the last items worked through to close a deal, and now, it is one of the top priorities. We recommend obtaining a strategically selected cyber insurance application to have the seller complete early on in the diligence process to identify potential gaps in security and determine the best path to obtain coverage. Ideally, cybersecurity diligence is also started early so that a buyer can effectively predict the potential additional cost to put the proper controls in place.

For more on this topic, including the critical cybersecurity controls underwriters are looking for and how to navigate the diligence process, reference this article here.

emerging trend: transactional insurance

Similar to cyber, transactional insurance is not new, but recent developments have made it a higher priority. Here are the latest updates that you should be aware of:

- Representations & Warranties Insurance (RWI) prices are increasing. RWI coverage is effectively purchased for these reasons

- The seller requires it (for a cleaner exit – proceeds can be distributed right away)

- The buyer wants to differentiate their bid

- The risk tolerance is low for one or both parties

- RWI coverage is now available on micro deals (< $10M Enterprise Value). RWI traditionally was only available for deal sizes over $25M or $50M. But a new product called Transactional Liability Private Enterprise (TLPE) has entered the market. It provides Reps & Warranties-like coverage to the sellers of smaller businesses at a much more affordable rate than the typical RWI policy minimum of $125K-$150K in premium plus underwriting costs.

The premium we’ve been seeing is in the 1-3% of deal size, typically around 1.5% (i.e., $5M deal, $75K premium) with a limit equivalent to the deal size (i.e., $5M in this example).

This article about TLPE insurance should provide more insight.

- Tail policies – To require or not? Traditionally, the term “transactional insurance” refers to representations & warranties, tax indemnity insurance and contingent liability. For the purposes of this article, we’ll also use the term to include tail policy considerations and what to require the seller to purchase.

If the decision is made to purchase Reps & Warranties coverage, it also drives the requirement to place other policies. These include tail policies or extended reporting period endorsements for Directors & Officers Liability, Employment Practices Liability, Fiduciary Liability, Errors & Omissions Liability and Cyber Liability. There are also “naked tail” policies available if the seller doesn’t currently have this coverage in place.

At times, there is a misconception that if you purchase RWI, you don’t need a tail. In most cases, that’s false. RWI traditionally covers the risks that the standard insurance market (including tails) does not address.

Typically, tails aren’t brought up far enough before close, and the additional insurance requirements can catch a seller by surprise, sometimes turning the issue into a bargaining chip or an area of contention. We recommend discussing the topic as far in advance as possible.

For more on this topic, including which policities require tails, please reference this article about tail policies.

Roll Up Due Diligence: 3 Tried & True Tips

- Establish a Process for DiligenceWhat’s important? What do we need? By when? It may sound simple, but that’s because it is. Experience matters. Select a broker with diligence experience who can help you make decisions as you work through the diligence process. Determine if there are any items of specific concern, what kind of information needs to be obtained and assessed (a strong broker will have a process) and when your team needs it completed. One of the most challenging parts of the process is getting the right information, so pay specific attention to the cadence of requests, prioritization of items, and how to continue providing insights if the information isn’t obtainable.

- Cost

Is this deal going to save money or cost money? This is the most common question we’re asked to address in our reports. What’s most often the case is that the deal ends up being close to a wash in roll-up situations. There are typically economies of scale savings on the core lines of coverage (property, liability, auto, and workers compensation). At the same time, there are typically additional costs to right-size the tuck-in’s insurance program, which includes purchasing coverage or limits that the tightly-held entity didn’t feel were necessary (Directors & Officers, Employment Practices, Fiduciary, Crime, increased Cyber or Umbrella limits, etc.). Despite the norm, the work still has to be done to determine any significant changes in cost on a go-forward basis, whether at the close or in the first few years following the acquisition.

Other factors that could impact future costs of the deal would be:

- Loss Experience

- Experience Modification Rate Integration

- Safety Programs

- Controls (from Cybersecurity controls to a facility lacking sprinklers with high hazard contents present)

- Geography/High Hazard areas (i.e., Florida property or the California legal environment)

- High hazard products or service offerings (different from the norm)

Depending upon the industry or customer contracts, having an experience modification rate over 1.00 could cause the selling or buying entity to lose a customer or project. So, it’s important to note if any of those requirements exist.

- Post-Close Priorities

Onboard the main operators and implement key safety initiatives. The deal isn’t done when the transaction closes – typically, it’s when the real work begins. Every situation is different, but a process should be developed to build a relationship between your insurance partners and the key operators that can impact change. Depending on the industry, insurance and safety may not be the biggest priority. However, it could be one of the top priorities for a blue-collar business like manufacturing, distribution, or trucking.

Educate the operators on who their new partners are (carriers and brokers) and what resources are available. Provide ideas on how they can improve, keeping in mind that their goal should be to enhance employee safety and decrease losses, ultimately leading to lower insurance costs.

ERM-14: Another item commonly missed in roll ups is the completion of an ERM-14, which is a Workers Compensation form that is required within 90 days of close and provides the NCCI or applicable Workers Compensation Rating Bureau with the necessary information to integrate the experience mod.

A close relationship between your insurance/risk advisory partners and the operators you hire to run your portfolio companies is critical. Choose a partner who will treat your operators the same way they treat you.

Final Thoughts

You’ve got enough to worry about. Toss the diligence to experienced professionals. You could manage this entire process yourself, or you could just simply select an insurance professional to navigate this for you, bringing the critical items to your attention when necessary.

Happy Hunting! Reach out to Horton to help with your next deal or roll up.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.