What is Umbrella Insurance?

Umbrella insurance, often referred to as excess liability insurance, is an added layer of protection that supplements your standard insurance policies such as homeowners, auto, and boat insurance. This policy comes into play when the liability limits on these standard policies are exhausted, covering you beyond the standard limits and safeguarding your assets.

The Importance of Umbrella Insurance

In an increasingly litigious society, the risk of facing substantial financial loss due to lawsuits or accidents is escalating. Having an umbrella policy could shield you from such financial disasters, providing protection that extends far beyond the coverage limits of your existing insurance policies.

Liability Claims: A Rising Concern

From dog bites to car accidents, your everyday activities could potentially lead to a lawsuit. Consider the astronomical medical bills or the legal costs associated with such incidents. Your standard insurance policy might not be adequate to cover these, but an umbrella policy is designed to take care of such excess costs.

Asset Protection: Safeguarding Your Future

The benefits of umbrella insurance aren’t limited to just handling the costs of liability claims. It also protects your assets, ensuring your financial future isn’t compromised. Whether it’s your home, car, or even future income, an umbrella policy ensures your assets are safeguarded against lawsuits that can threaten your financial stability.

Calculating the Right Umbrella Coverage

The pressing question now is, “How much umbrella insurance is enough?” The answer varies greatly depending on personal circumstances, assets, and potential risk factors.

Evaluating Your Risk

Firstly, evaluate your personal risk factors. Do you engage in activities that could potentially lead to liability claims? These could range from owning property, having a swimming pool, to owning pets, or teenage drivers.

Assessing Your Assets

Secondly, take stock of your assets. The value of your assets, including personal property, savings, stocks, and future income, should guide the amount of coverage you seek.

Potential Liability

Lastly, consider any potential future liabilities. Are you planning on purchasing a new property? Expecting a significant increase in income? These should factor into your decision when deciding on the coverage.

Recommended Umbrella Insurance Coverage

As a rule of thumb, your umbrella coverage should at least be equal to your net worth. However, it’s always wise to have a bit more coverage than your net worth to ensure you’re fully protected against any lawsuits or liability claims.

The Million-Dollar Question

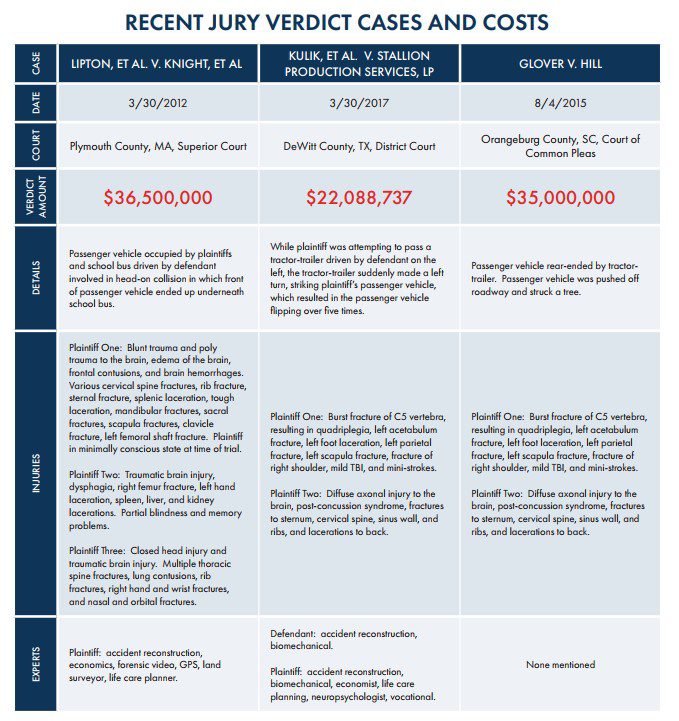

Many insurance advisors recommend a minimum of $1 million in umbrella coverage for most people. This might sound excessive, but when you consider the cost of legal fees, medical bills, and potential damage awards, it’s clear that such costs can easily reach into the millions.

Beyond the Million: When is More Needed?

While $1 million is a good starting point, your personal circumstances might necessitate more coverage. If your assets exceed $1 million or if you have significant risk factors, it’s recommended that you opt for higher coverage. Some individuals with extensive assets and higher risk factors might require coverage of up to $5 million or more.

The Balancing Act

Choosing the right umbrella coverage is a balancing act between risk and protection. While it’s crucial to protect your assets and future, it’s equally essential to ensure you’re not over-insured. Regularly reviewing your personal circumstances, assets, and potential risks can help you maintain the right level of coverage, ensuring you’re adequately protected at all times.

Remember, umbrella insurance is not a luxury, but a necessity in today’s world. It’s the safety net that catches you when your standard insurance policies fall short. Therefore, make sure you have enough coverage to fully protect you.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.