The commercial auto insurance industry in 2022 is ever-evolving, and technology and data continue to play a vital role in the premiums that companies pay for their commercial trucking fleets. As we continue deeper into 2022, businesses will see shifts in several factors that will push the price of commercial auto insurance premiums higher.

Vehicles are becoming much more expensive while also becoming more technologically advanced. With more computer chips and more bells and whistles, the costs add up when dealing with commercial auto fleets.

While auto prices go up, the ability to staff commercial auto fleets appropriately with qualified drivers is increasingly becoming a bigger problem. There is a shortage of qualified labor, and companies are frequently scrambling to fill roles.

(Click image for download)

Zywave, 2022. 2022 Commercial Auto Insurance Market Outlook. [online] [Accessed 17 January 2022].

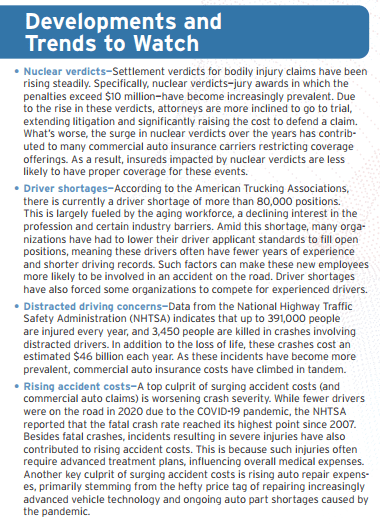

What are the key topics to watch in the commercial auto industry in 2022?

Nuclear Verdicts

Nuclear verdicts are on the rise, and it starts with negligent entrustment. If you do not have policies and procedures in place that let a judge know that as a company, you are doing everything that you can to hire qualified drivers, there is only so much cost control you can apply when the verdict comes.

In contrast if, as an organization, you can prove that you have covered all of your bases from a safety perspective and followed all policies and procedures, you will have a better chance at fighting off the nuclear verdicts against your company. Negligent entrustment can come from not having a proper safety program for your organization and not educating your employees on the importance of safety. Don’t leave your organization open to the risk of a nuclear verdict.

Driver Shortages

As you survey the current state of the job market in the U.S., there are hiring signs everywhere. Not just in the commercial auto industry. Any industry, city, and state you look there are talks of “The Great Resignation” as employees choose to either change jobs or quit altogether. Companies need qualified employees, and in the commercial auto industry, you need qualified drivers that can safely drive their fleets while not leaving the company with a fear of a potential accident. The more accidents that happen, the more expensive it becomes to replace cars and trucks in the fleet while also dealing with the insurance costs.

At the same time, companies might increasingly feel the need to cut corners and hire unqualified workers to compensate for staffing shortages. This will build into the increased prevalence of nuclear verdicts in commercial auto for 2022, as more companies are found to be at fault for unsafe hiring practices. Couple this with the fact that for the employee base, the workforce is starting to transition from boomers that are retiring to millennials that are starting to get into the core years of their careers. Not only is there a shortage of drivers that employers need to be sure they’re not cutting corners with at the expense of quality, but the younger workforce has a whole new set of distractions that employers must continue to be aware of and monitor.

Distracted Driving Concerns

Distracted driving concerns will continue to rise with premiums. Texting while driving and checking social media behind the wheel are too common. But just as technology can cause problems for a company and its fleet drivers, it can present many solutions as well.

Many companies now implement applications on their company phones to mitigate the risks of distracted driving due to phone usage. For example, some installed applications make it so that once the driver gets into the vehicle, they cannot make or receive a phone call unless they use a hands-free Bluetooth device. Other companies install car dashcams that monitor their drivers’ actions while inside the vehicle and implement dashcams facing the outside of the vehicle to catch any potential accidents.

Premiums will continue to rise due to accidents from distracted driving on the job. Mitigating the risks for companies starts with continuously educating your workforce that distracted driving habits exist and combating them personally while also implementing technology that can help monitor, aid, and improve your drivers’ actions while on the job.

Rising Accident Costs

Inflation continues to impact the cost of everything from food to construction materials to auto parts. Everything is becoming more expensive. In 2022, as accidents happen, it becomes more expensive to replace the different automotive parts of your fleet. Coupled with insurance premium rates rising due to accidents, rising accident costs must be avoided by having the correct safety measures in place from hiring qualified employees to avoiding distracted driving. An accident due to failure to accomplish either of these tasks could result in drastic rate hikes.

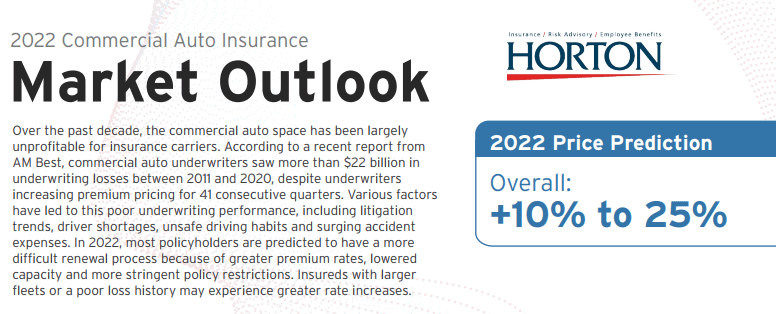

2022 Commercial Auto Insurance Market Outlook

(Click image for download)

Zywave, 2022. 2022 Commercial Auto Insurance Market Outlook. [online] [Accessed 17 January 2022].

What is still lacking for businesses that carriers understand?

Any time insurance companies are evaluating submissions with a commercial auto fleet, they want to see that the companies have strong policies and procedures in place. This starts with seeing if companies have safety manuals, finding out what they’re doing for Motor Vehicle Records (MVRs), and even proactively naming who their MVR company is that they use. But what can companies do then if policy renewals continue to become more difficult and expensive, restrictive, and there seems to be not enough qualified employees?

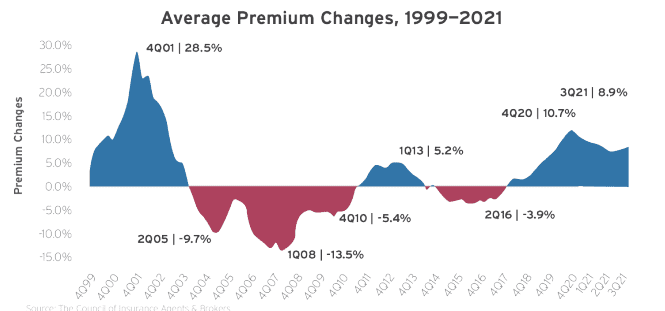

Premiums will continue to rise for commercial auto in 2022 as carriers increasingly compete for business with the smart use of technology and data. You can still make it easier for carriers to bring your premiums down.

Historically this is an unprofitable line of business for carriers. As you work on your insurance coverage for your fleet in 2022, formulate your business insurance and safety plans from a carrier perspective. The carrier’s goal, much like any other business, is ultimately to make a profit. With commercial auto increasingly becoming unprofitable over the past decade, what can companies do to make themselves more enticing to do business with?

Use telematics.

With telematics, you can create an incentive program where, for example, every month you can hand out a bonus to the safest driver. In telematics programs, each driver is given a score. It becomes a safety competition as some companies might have up-to-date company scores on all driver’s dashboards and on a screen in their office. This lets all drivers in the fleet see who’s safe and who on average gets the safest driving score each month. Drivers are then compensated accordingly. In turn, this develops a culture of safety within an organization with a commercial fleet to always want to operate safely. This is also the type or program that carriers increasingly want to see. But to impact your potential commercial auto premiums even more, businesses take this a step further.

Use the data from telematics.

If you can tell carriers that you have a telematics program in 2022, this can positively impact your insurance prices. But what carriers really want to know is what you are doing with the data. What you’re doing with the data is the next level in positively impacting your commercial auto premiums. Telematics has been around for quite some time. For carriers, everything is now shifting to innovative ways to utilize the data from telematics.

The more years advance, the more competitive carriers must be in terms of their insurance product offerings and what discounts to offer. In the last two years, it has been a big trend in the industry to help insureds develop a true risk management program that is set to one day become just standard practice. It’s becoming increasingly common for businesses with commercial auto fleets to be provided with two quotes, one with the company implementing this free fleet management monitoring and one without it.

For businesses, that includes a 10% participation discount for enrolling their fleet into a telematics program and a chance to earn up to 15% off premium discounts. As carriers can more accurately identify the commercial auto fleets that are top performers from a safety perspective through the telematics data, costs for auto premiums can remain low.

Pushback from employees and companies is inevitable.

Ultimately there will be pushback that all employed drivers of the fleet will give. They might state that they’re being watched. In the end, it’s how you deliver the message to your employees. Explaining the why can go a long way in helping your company stay safe and use technology to your advantage. State to your employees that implementing all of this saves the company X amount of money and insurance premiums, which then yields X amount of money that we can give out to the staff in bonuses. Companies might also think that if they implement this, the insurance carrier will use the data to disqualify them from or cancel them if they had maybe one or two instances of speeding. Sometimes people will be speeding. But there’s a discipline side of it.

It’s important to know that for the carriers themselves, they don’t monitor the data actively where they say, “XYZ construction just had three vehicles that were speeding over 80 miles an hour. We’re going to cancel their insurance.” Note that these carriers aren’t doing that. They’re offering this as a value add that carries insurance policies into the technological future where data dictates your policy premiums intelligently. This is where commercial auto technology and fleet safety are going. Carriers must continuously be more competitive in terms of their product offerings. Once one carrier starts to offer free telematics technology and more accurately determines premiums using data, others will start to slowly adapt it because if they don’t, they will fall behind the curve. Alerts for harsh braking, high speed, rapid acceleration, and geofencing become more vital in the collected data.

(Click image for download)

Zywave, 2022. P&C Market Outlook 2022. [online] p.4. [Accessed 17 January 2022].

Commercial Auto Insurance Buyers in 2022

Ultimately, the lesson to be learned is that with commercial auto insurance premiums on the rise in 2022, rate decreases can still be obtained when businesses work with a qualified broker that understands all the variables discussed above and has the appropriate knowledge, techniques, and network to help your business cut its insurance costs. Implement X, Y and Z and then develop a strategy on approaching the insurance market to make sure the risk of doing business with you looks to be a cut above the rest.

Final Key Considerations for Commercial Auto Insurance in 2022

Your commercial auto fleet and its drivers are your most important assets. Make sure to keep commercial auto insurance at the top of mind as you continue into 2022:

- Protect your assets as best as you can through safety programs and technology to make the driving experience safer.

- Keep a good loss ratio.

- Hire quality employees that are going to take care of your vehicles.

- Consistently meet with your organization to highlight the importance of the policies and procedures that you have in place.

Keep this simple by having your policies and procedures documented so that when you hire somebody new, you know what you need to do a pre-trip inspection, post-trip inspection, and ensure your vehicles are serviced appropriately to avoid potential pitfalls later down the road.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.