One of the most common questions we receive is whether Reps & Warranties Insurance policies actually pay claims. Our friends at Lowenstein Sandler’s Insurance Recovery Group set out to answer this question, and did so with several key findings. Claims are being paid. But successful claim resolution has become more dependent on having the right broker and legal partners to help you navigate the claim process.

Their full report is below. Reach out to Horton’s M&A Practice to discuss this in more detail.

Changing Times for R&W Insurance Claims

As we emerge from the COVID pandemic and the risk environment for corporate America remains high, now is a good time to revisit a question critical to private equity firms and strategic buyers in the mergers and acquisitions (M&A) community: Do representations and warranties (R&W) insurers still pay claims? The answers will surprise you.

At the beginning of 2020, on what turned out to be the eve of the pandemic, Lowenstein Sandler’s Insurance Recovery Group first ventured to answer that question because clients purchasing R&W insurance (RWI) asked it. By 2020, RWI had become a staple of M&A transactions because sellers required a swift and permanent exit from the transaction—and, given the frenzied pace of deal flow and heightened competition in the market, they could demand it. But buyers wanted to know whether RWI claims were handled differently from claims under more mature and commoditized insurance policies. In other words, would R&W insurers behave substantially like a seller that provided a contractual indemnification, i.e., in a commercial manner, or would the insurers look for ways to avoid reasonable, fair, and prompt resolution of claims?

We surveyed RWI market stakeholders to develop a data-driven answer to that crucial question.

The results—published in our August 2020 report “Getting Paid: A Look at Representations & Warranties Insurance”—showed that the vast majority of claims presented for coverage (71 percent) fell entirely within the self-insured retention (SIR). But when buyers needed coverage for claims that exceeded the SIR, R&W insurers generally honored their coverage obligations, with 87 percent of respondents reporting that a negotiated claim payment was made. At that time, we noted that the playing field appeared uneven because so many claims fell within the SIR, and we predicted a need for recalibration of the risk transfer model. We also observed that policyholders had many tools available to position their claims for early and reasonable resolution along with maximum recovery.

Fast-forward to 2023. As market conditions have changed dramatically during the past three years due to the pandemic, significant event-driven litigation, the emergence and explosion of special purpose acquisition company (SPAC) transactions, and a new laser focus in the board room on environmental, social, and governance (ESG) issues, the time seemed right to take another look at RWI claim trends and how the market was maturing.

Our refreshed RWI claim survey of 154 market participants (private equity, investment banking, strategic buyers, insurance brokers, and insurers) reveals surprising results. Some aspects of RWI claims remain steady. For example, the time it takes to resolve a claim is about the same (though trending up), and financial statement breaches remain the predominant type of claim that follows, usually shortly after a transaction closes.

However, many differences and new trends have developed in only three years. The most significant change is in how R&W insurers approach claims. While buyers increasingly need access to RWI for claim payments because sellers will not provide traditional indemnification, securing payment for claims has become much more challenging—it takes several years to get paid, the claim process is adversarial and resource-intensive, claim payment values are coming down, and more litigation and alternative dispute resolution (ADR) proceedings appear to be on the horizon.

Our survey also revealed an important and surprising trend about why it is taking so long to navigate the claim process: insurers are digging into the fundamental issue of whether a breach has even occurred; and then getting bogged down in how to value the loss that flows from the breach. Policyholders are perplexed and frustrated because they expect R&W insurers to understand the deal, the nature of the business operations, and the risks that were assumed when the R&W policy was sold.

In other words, the RWI claims market is headed in the direction of becoming a commoditized insurance product that does not fit the needs of M&A stakeholders, who expect the RWI policy to function as an effective and responsive risk-transfer solution. The players in the M&A space expect speed, return on investment, and rational commercial behavior– they do not have time for, or interest in, litigation or “re-due-diligencing” the deal through an insurance claim process. R&W insurers will be well-served to implement an immediate course correction so that consumers of the RWI product continue to see value in it.

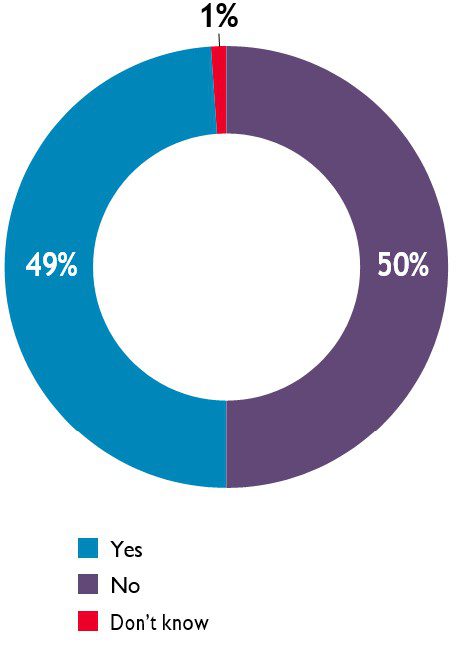

Finally, our survey revealed that new types of claims and breaches are emerging. Of particular note, cyber/ privacy claims are gaining fast on financial statement breach claims for the top slot and environmental claims ticked up. Most interesting of all, ESG has made an immediate impact in the RWI claims space—and that applies to both ESG-driven and ESG-focused companies—with 49 percent of respondents reporting a breach claim involving an ESG company and 32 percent reporting that the claim itself involved the breach of an ESG representation.

Key Report Findings

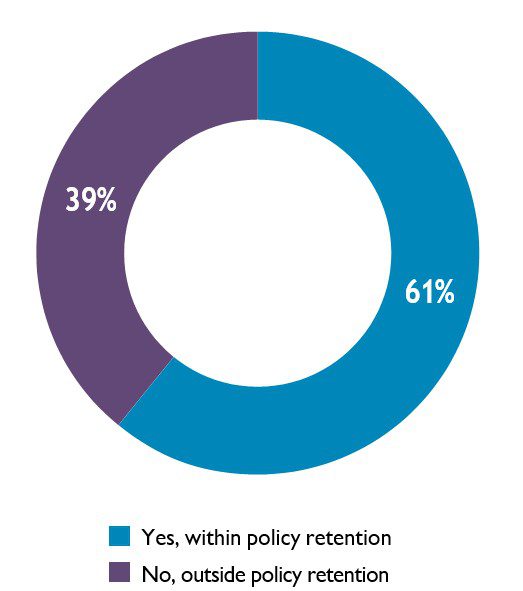

- Buyers increasingly rely on RWI: 61% of respondents reported claims entirely within the retention.

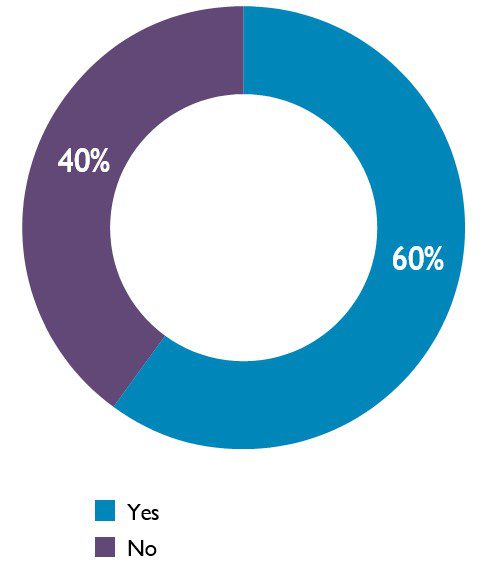

- A more challenging claim process: For claims exceeding the SIR, 60% of respondents reported that a claim payment was negotiated, but it continues to take time (often one to three years) to get to the actual recovery stage.

- ESG companies are are not immune: 49% of respondents reported breaches involving an ESG-focused or ESG-driven company.

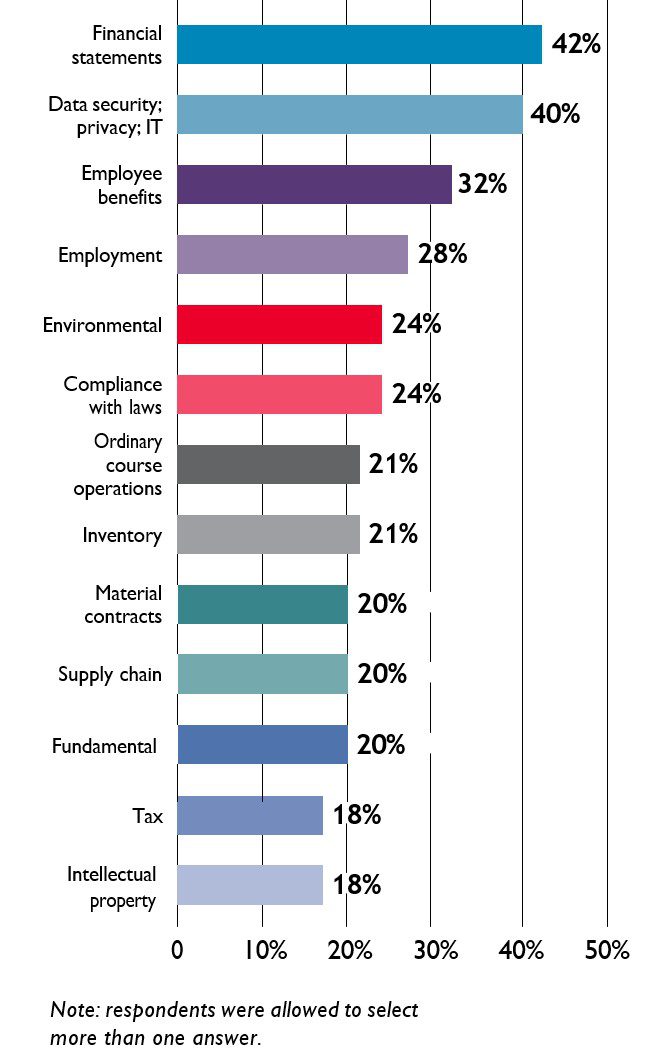

- New and emerging breaches: Financial statement breaches remain the leading breaches reported by respondents (42%), but data security/privacy breaches (40%) and environmental breaches (24%) increased.

- New “center stage” coverage defenses: When asked about reasons R&W insurers denied coverage for R&W claims, respondents report R&W insurers increasingly challenge the existence of a breach (40%) and the amount of loss (47%) to deny coverage. Insurers also have not hesitated to invoke COVID/CARES Act exclusions (20%).

Buyers Increasingly Rely on R&W Insurance

We start with the obligatory but true statement: R&W insurance has been, and remains, popular in M&A transactions. But as RWI has increased in popularity and remains vital to deal-making, R&W insurers (not surprisingly) have reported increases in both the frequency and severity of claims in recent years.

That is consistent with our finding that more RWI claims exceed the policy’s SIR, i.e., the amount the policyholder must absorb before it can pursue recovery from R&W insurers. Respondents reported that 61 percent of the claims submitted for coverage fell solely within the SIR, down from 71 percent in 2020. Further, the vast majority of respondents (88 percent) reported involvement in more than one RWI claim.

Did all of the R&W insurance claims result in losses that were entirely within the R&W policy retention?

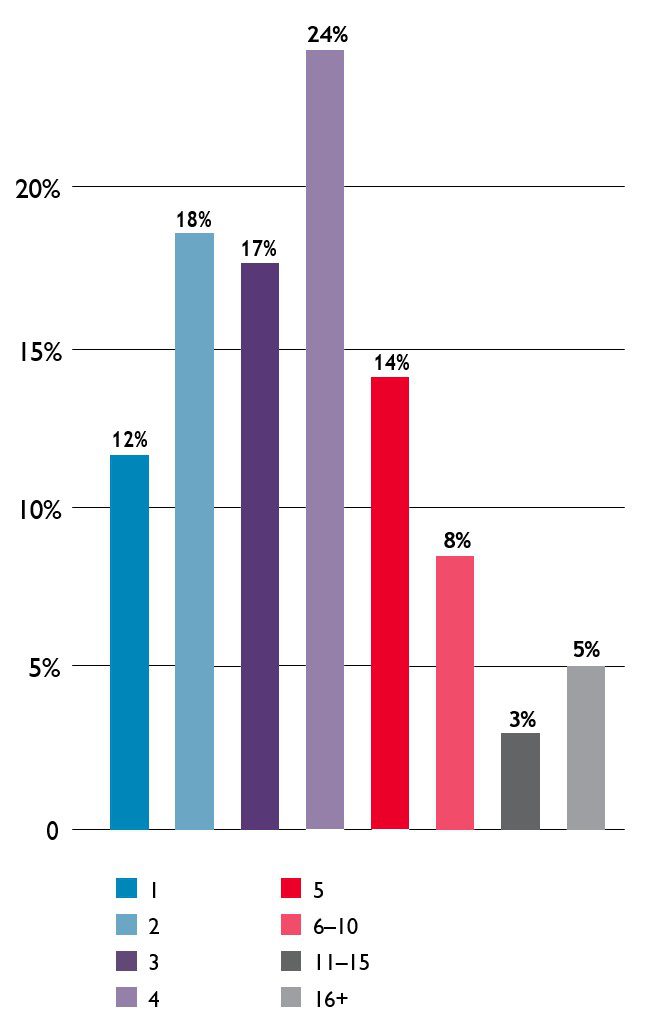

Within the past 36 months, how many R&W insurance claims has your organization been involved with?

There Are Likely Two Drivers Behind These Trends

First, the severity of claims has risen, meaning that when a breach occurs, the buyer is experiencing a greater level of loss. Given the speed with which deal flow has moved over the past several years and the fact that R&W insurance was one of the final pieces placed in the transaction puzzle, diligence likely was less than ideal and larger claim values are to be expected.

Second, as we predicted in our 2020 survey report, competition within the RWI market drove SIRs lower, making it easier for policyholders to access their insurance coverage sooner.

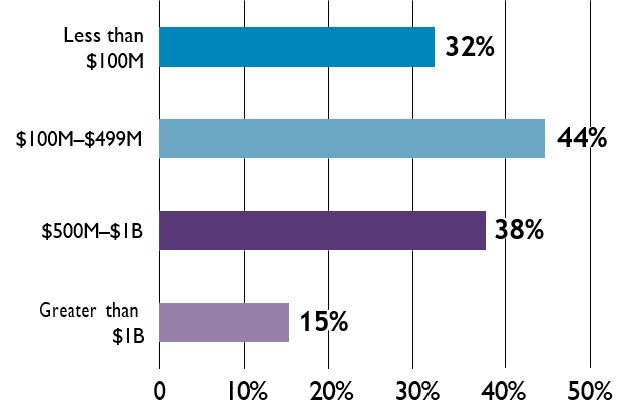

For example, on larger deals (greater than $500 million) where there is meaningful claim activity (see Deal Sizes on page 15), initial retentions are lower than the standard 1 percent of enterprise value (EV)— sometimes as low as 0.5 percent of EV. To be sure, for deals below that threshold, an initial SIR of 1 percent of EV generally remains “market,” but retentions of 0.75–0.9 percent of EV were also achievable while deal flow remained high.

The increase in claim frequency and severity and decline in initial SIRs reinforce for M&A stakeholders the importance of RWI: It is a resource to protect against breaches, and it can provide value.

That, of course, raises a question: Do R&W insurers deliver on that value proposition?

Do R&W Insurers Still Pay Claims?

R&W insurers, which are committed to the long-term viability of this market, should recognize that increased claim activity (even if spurred by lower SIRs) is actually a positive dynamic. Providing meaningful risk protection to M&A buyers that experience unwelcome surprises post-closing actually solidifies the necessity and value of R&W insurance. That, in turn, should maintain high demand for the product and allow R&W insurers to grow market share and more effectively spread risk.

But “need” is only one piece of the “demand” equation. Demand can be maintained only if RWI is responsive to claims.

R&W insurers appear poised to change the spirit of the process. As claim experience has increased and demand for RWI in M&A deals remains strong, short- term thinking may have overtaken R&W insurers.

When adjusting RWI claims, insurers have become increasingly more entrenched and, in turn, the commercial approach that M&A buyers expect in any post-closing breach scenario has diminished. Indeed, it was surprising that only 60 percent of respondents reported that, for claims exceeding the SIR, a negotiated resolution of the claim was achieved. This is a sharp decline from the 87 percent success in claim payment noted in the 2020 report.

Notwithstanding the insurer’s initial denial(s) of the claim(s) for claims where loss exceeded the retention, were the insureds able to negotiate a payment for each/all of the R&W claim(s) with the insurer(s)?

What does this mean?

For M&A buyers, when selecting an R&W insurer, the first question they need to ask of their broker, R&W policyholder advocate, and deal counsel is: Does this R&W insurer pay claims? And that question needs to be followed by: What is your experience with their claim process? Are they adversarial? Do they delay? Do they behave like a traditional insurer or a rational actor in the context of a post-close M&A transaction? Without satisfactory answers to these questions, a buyer can negotiate the strongest R&W policy, but it will not mean much. Moreover, with RWI proposals often containing substantially similar terms and pricing, paying claims is the best way for an R&W insurer to stand out in a competitive market.

For R&W insurers, they need to get back to the “old” normal of negotiating and paying to avoid parties reverting to the structure where sellers would largely stand behind contractual indemnifications. Insurers cannot rest on current demand and make the claim payment process prolonged, difficult, and ultimately unsatisfactory. If R&W insurers fail to respond to buyers’ needs for speed, ROI, and rationality in the claims handling process, they run the risk of killing the goose that laid the golden egg.

Therefore, R&W insurers must guard against treating RWI like a commoditized insurance product and the claim process becoming as cumbersome and difficult as those that policyholders often encounter on other lines of coverage. The not-so- secret success of RWI is that, because it was born out of the fast-paced world of deal-making, it requires commerciality, reasonableness, and speed. Maintaining that uniqueness going forward in the RWI market (in contrast to the insurance market in general) ensures that buyers will continue to accept—rather than try to resist—RWI as an integral part of M&A deals.

RWI Claim Investigations Continue to Lag

To be clear, commerciality does not mean that R&W insurers should be expected to just roll over and pay every claim when a demand is made. Insurers must be permitted to vet claims and conduct a reasonable investigation. However, our second look at the claims handling process reveals that it still takes too long and has become increasingly contentious. Where there once was a light at the end of the investigation tunnel for buyers in the form of a negotiated claim payment, this survey shows that the investigation is far more arduous, and the light has dimmed.

Coverage Positions: The claim process can get off to a rocky start because R&W insurers overpromise and under-deliver. In R&W policies, insurers often promise to provide a coverage position within 45–60 days after receiving the claim. But more than 50 percent of respondents report that it takes over six months for R&W insurers to provide an initial coverage position for the claim.

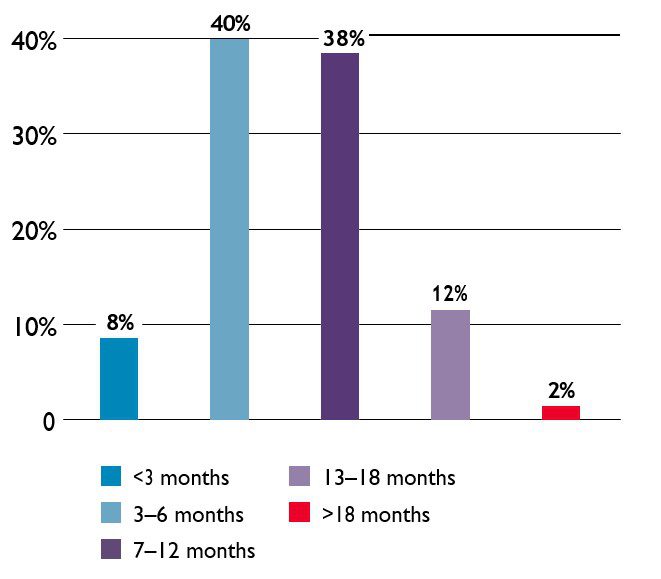

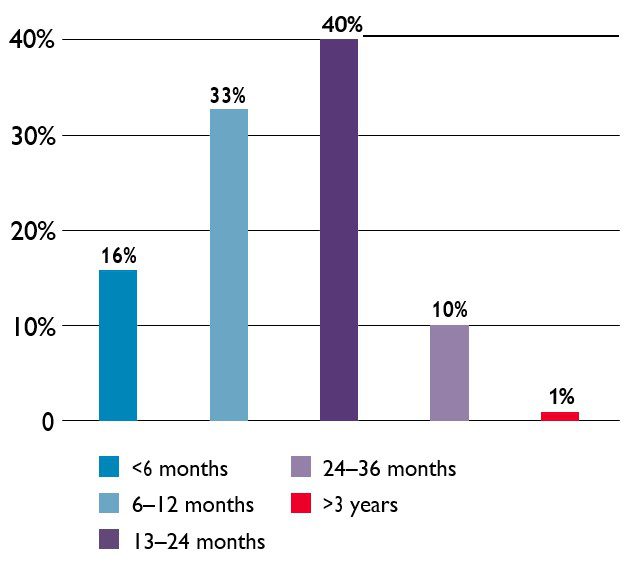

On average, from the time the R&W insurance claims were submitted to the R&W insurer(s), how long did it take for the insurer(s) to provide a coverage position?

R&W insurers should adjust their one-size-fits-all time frame to communicate a realistic response time to their policyholders depending on the type of claim presented. Forty-five days is certainly sufficient (and may even be too long) to acknowledge a defense cost obligation for a third-party lawsuit since the information needed to confirm the existence of a breach is straightforward. A different time frame should apply to a financial statement breach claim, given the complexities associated with evaluating the loss flowing from such a breach. It would be a mistake, though, for R&W insurers to simply eliminate any timetable for responding to this kind of claim, because it is the most common and financially significant; and buyers will continue to look for speed, ROI, and some level of certainty before investing further in RWI policies. In our experience, recognizing that the facts of each claim always matter, as a rule of thumb, six to nine months is a reasonable time frame to expect the R&W insurer to be in a position to provide a meaningful coverage position for a financial breach claim. In the event that the financial statement claim presents a full tower loss scenario, one year is a more realistic measuring stick.

Lag Times Remain: Fifty-one percent of respondents report that the time from claim submission to payment is one to three years, up from 46 percent of respondents in 2020. This departs from the expectations of strategic buyers and private equity firms, which are historically accustomed to a swifter process—usually spurred by the deadline for the release of any escrowed amounts—when they exercised indemnification rights against sellers.

On average, from the time the R&W insurance claims were submitted to the R&W insurer(s), how long did it take for the insurer(s) to make payment on the claim(s)?

Know Your Customer: During the M&A deal—and the underwriting process—buyers (private equity, hedge funds, strategic buyers) are on the move. Their goal is often to close the deal as soon as possible, with all parties working long hours, nights, weekends, and holidays to do so. And when the R&W insurers are trying to earn the significant premiums charged for these policies, they keep up with the deal pace. They need to, or they will not be in the market for long.

But, that urgency to keep up ends when the claim comes in. R&W insurers need to remember that when the buyer-turned-policyholder makes an RWI claim, it is still the same buyer that closed the deal with a “need for speed” mindset. Buyers question how they can negotiate, diligence, and close a transaction valued in the tens or hundreds of millions of dollars or billions of dollars in a matter of months, while getting paid on RWI claims (that are worth far less than, and only involve a segment of, the deal) takes years.

To the extent R&W insurers are inclined to evaluate their claim processes, they would be well-served to remember that claim investigations boil down to customer service and actual payment of claims.

Most Common Coverage Defenses

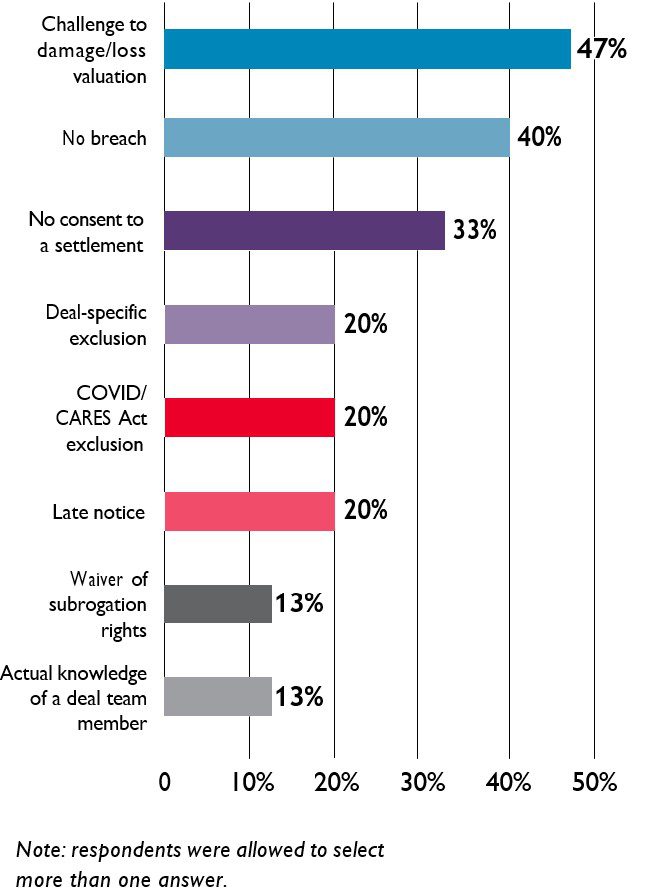

What was the R&W insurer’s asserted basis for the denial(s)?

The “need” for ever more information is a common R&W insurer refrain that impedes claim resolution. While buyers should be prepared to respond to reasonable information requests, R&W insurers need to significantly streamline and “right size” the information gathering phase of the claims handling process.

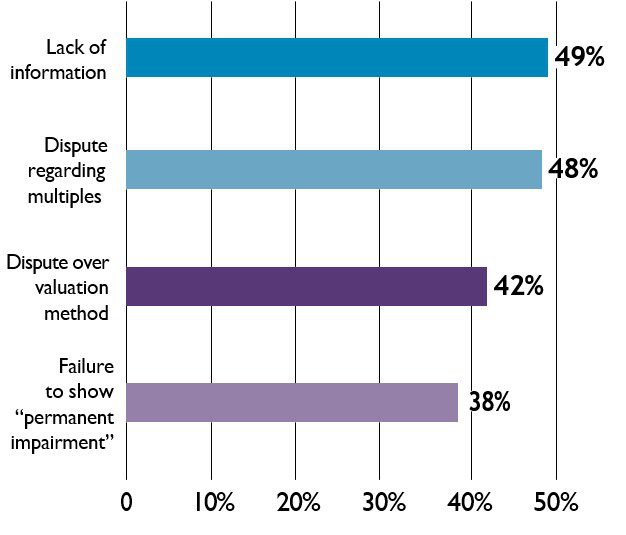

Challenges to multiplied damages claims are not surprising—R&W insurers attribute those loss valuations to the claim severity they have been experiencing. The challenge for buyer policyholders is that the law on proper valuation of loss is limited and may remain hidden behind the curtain because many R&W policies still contain ADR provisions (which can, and should, be negotiated out of the policy terms).

What’s Up From 2020?

- Insurers are more focused on challenging the existence of a breach and the amount of loss.

- Failure to obtain insurer consent to settlements jumped from 18 percent in 2020 to 33 percent in 2023.

- Insurers still cite late notice as a reason to avoid payment of otherwise meritorious claims (20 percent, up from 13 percent in 2020.

How are insurers challenging the buyer’s loss?

Communication Is Key: R&W policies have buyer-friendly insurer consent and notice requirements. Although consent usually cannot be unreasonably withheld, conditioned, or delayed by insurers and they must show prejudice by the delayed notice, policyholders can avoid these coverage defenses by keeping insurers apprised of the claim and key claim developments.

What Else Has Changed?

- Actual knowledge defense is materially down to 13 percent, from 39 percent in 2020.

- Waiver of subrogation was a significant defense in 2020, with 38 percent of respondents reporting that an insurer tried to avoid coverage on this basis versus only 13 percent today.Supply chain impacts and failure to prevent the transmission of COVID were the most prevalent COVID coverage defenses.

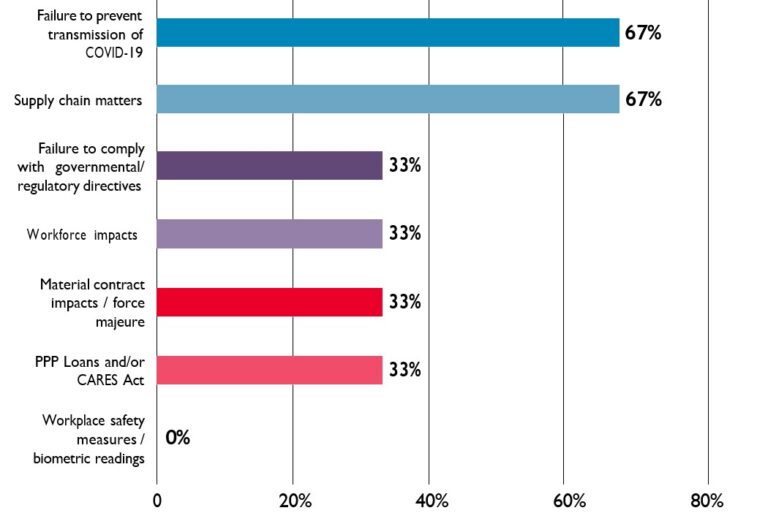

- COVID, of course! R&W insurers did not hesitate to include, then invoke, COVID exclusions placed in R&W policies. Twenty percent of respondents reported that this defense was raised in response to a claim.

- Supply chain impacts and failure to prevent the transmission of COVID were the most prevalent COVID coverage defenses.

Insurers have high burdens to succeed on these coverage defenses (e.g., showing a deal team member had conscious knowledge of breach; proving seller fraud), which is likely why insurers are not invoking them as much.

Please identify the insurer’s stated basis for its COVID-19 or CARES Act Relief denial.

Where Are Claims Coming From?

Types of Breaches Reported: What was/were the type(s) of breach(es) that was/were the basis of the R&W claim(s)?

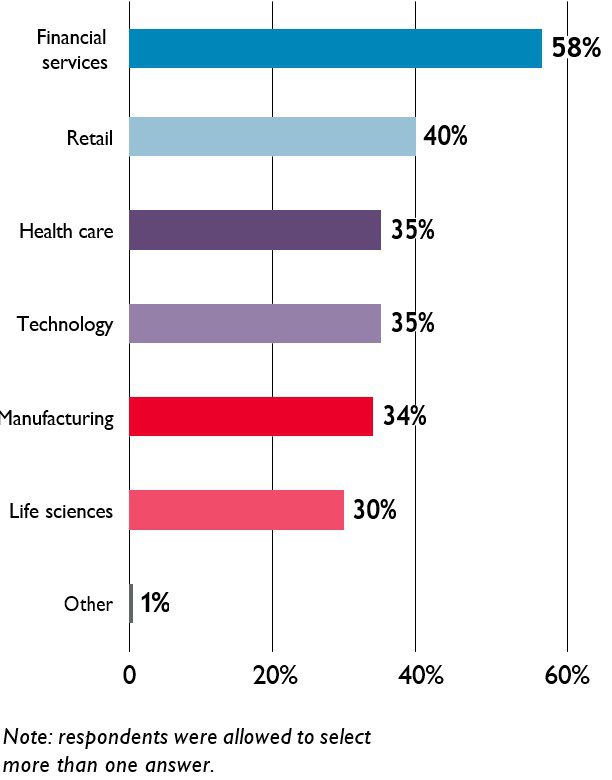

Industries Experiencing the Breaches: What industry does the Target Entity/Acquired Company, which is the subject of the R&W insurance claim, operate in?

Deal Sizes: What is/are the deal size(s) for the R&W insurance claims that your organization has made?

Financial statement breaches continue to dominate the claim landscape at 42 percent, though the percentage dropped from 55 percent in 2020.

As privacy and data security risk factors become increasingly important and sensitive, breaches involving these R&Ws now account for a material portion of claims experience.

There was also a significant rise in environmental breaches, which was likely a product of increased M&A targets in the manufacturing space, as well as increased regulatory activity following the change in administration.

Claim experience and liability risk factors on the broader legal landscape have informed, and will continue to inform, R&W insurers’ underwriting approach. Buyers should expect that R&W underwriters will continue to monitor legal liability trends and continue to diligence, and sometimes exclude coverage for, these risks.

Health care and life sciences are considered challenging industries, for which R&W insurers have limited appetite. But our survey results show that R&W insurers should reconsider their willingness to underwrite such deals: Claim experience is not out of the ordinary compared with other industries.

New Players in the R&W Insurance Market

ESG companies are not immune from RWI claims: As ESG has continued to receive greater emphasis in corporate operations, marketing, investment, and regulatory activity, ESG-focused and ESG-driven companies have not been immune from RWI claim activity. While conventional thinking may lead investors and insurers to see ESG companies as a “safer bet,” that has not yet been the case.

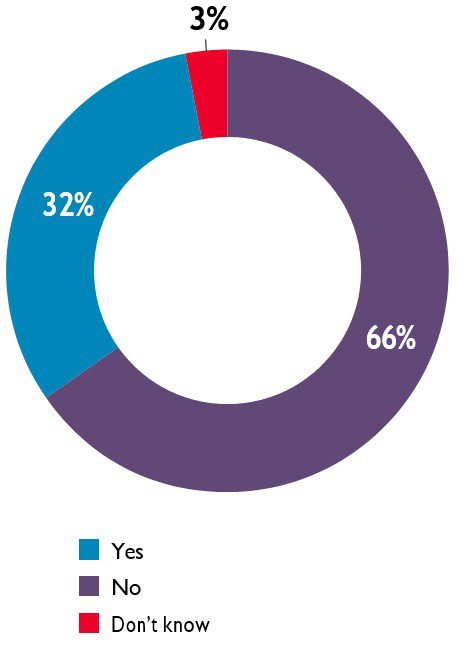

Respondents reported that 49 percent of claims involved an ESG-driven or ESG-focused company.

In fact, investment banking respondents reported that 66 percent of their claims involved an ESG-driven or ESG-focused company, the highest among the different respondents.

While ESG companies are not immune to R&W claims, neither are the associated representations and warranties made in the deal document that relate to ESG issues. Thirty-two percent of respondents confirmed that submitted claims involved an R&W related to ESG compliance, policies, and procedures.

Was the acquired company, which is the subject of the R&W insurance claim, an ESG-driven or -focused company?

Did any of the R&W insurance claims result from any breach of representations and warranties relating to ESG compliance, policies, or procedures?

SPAC transactions make up a low, but significant, number of claims.

Transactions involving SPACs are perceived as having higher risk profiles because, in part, parties seek to short-circuit the planning and due diligence process.

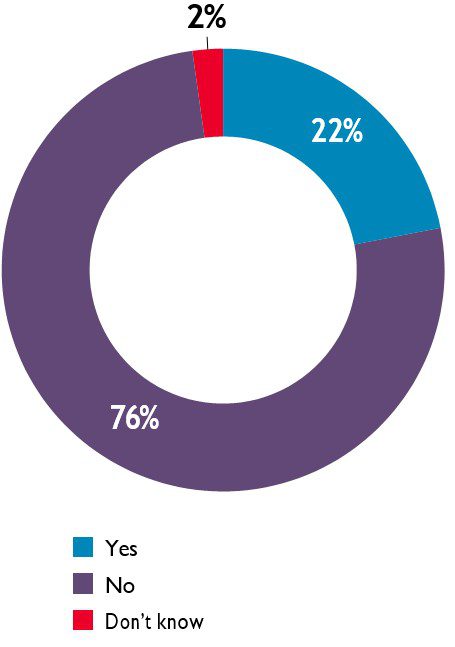

Twenty-two percent of respondents reported RWI claims that involved a SPAC transaction—which may, in fact, be high, considering that SPACs are a subset of the overall M&A transactions that RWI reaches and the SPAC market only started to take off in the second half of 2020.

RWI was touted as a benefit to SPAC deals because R&W insurers required a more robust diligence and underwriting process than the parties to the transaction may have otherwise undertaken.

But this claim experience may show that SPAC transactions are more difficult to underwrite, with breaches falling outside of traditional legal diligence. Narrative responses from respondents placed the breaches in the following main categories:

- Inventory/product issues

- Company’s key product was presented as functional when it was not functional, leading to misrepresentations to investors

- Misrepresented condition of assets/products

- Financial statements

- Incomplete information

- Misrepresentations regarding income sources

- Data security

Did any of the R&W insurance claims with which your organization was involved involve a SPAC?

Afterword

R&W insurance has transformed the M&A market for the better. It leads to smoother negotiations between buyer and seller with respect to the R&W and indemnification provisions in acquisition agreements; it allows buyers to obtain increased financial protection (in the form of higher limits) than they may otherwise have been able to negotiate from a seller in a traditional deal; it spurs more fulsome diligence—or diligence a buyer was not necessarily considering—as buyers work to address insurers’ underwriting questions; it helps avoid confrontation with sellers and management who remain with the target post-closing; it allows for a longer period to discover and make claims; and it allows market participants—whether private equity firms or strategic buyers—to avoid disputes among each other.

But none of those benefits will amount to much if R&W insurers do not approach claim resolution with an M&A mindset of commerciality and a focused, reasonable claim investigation, instead of making litigation-style requests to secure “perfect” information before negotiating payment of a claim.

To be sure, commerciality still exists. Sixty percent of submitted claims resulted in recovery under R&W policies, and that is a meaningful data point. The concern is that the process of “getting to yes” is becoming longer, more adversarial, and less commercial—none of which buyers of RWI expect when they purchase the policies and agree to allow the seller to walk away from the deal after closing. Today, and for years, buyers have acquiesced to using RWI—and have done so to remain competitive in the sale process (auction or otherwise). The last thing R&W insurers should want is for buyers to question the value of purchasing RWI or to push back on sellers’ demand for the use of RWI to replace their indemnification obligations. But if the claim process remains difficult and long, the strong demand (and substantial premium dollars) that R&W insurers may have assumed as a given for more than a decade might begin to evaporate. RWI has a strong history of commerciality in the claim resolution process—as evidenced by the result of our last survey and the 87 percent success rate on getting payment for claims that exceed the SIR, reported a mere two and a half years ago. As the RWI market continues to evolve and mature, all stakeholders will be well-served to stay true to how this risk transfer product is intended and expected to work.

Methodology

In late 2022, national law firm Lowenstein Sandler surveyed 154 executives involved in R&W insurance. Respondents included individuals holding a wide range of positions in private equity (23 percent), investment banking (23 percent), insurance brokerage (21 percent), insurance companies (14 percent), and operating companies (i.e., strategic buyers and sellers) (12 percent) as well as other market participants (7 percent).

In some cases, results total more than 100 percent because of rounding and/or because respondents were asked to select all options that applied, or respondents provided data for multiple claims.

Material posted on this website is for informational purposes only and does not constitute a legal opinion or medical advice. Contact your legal representative or medical professional for information specific to your legal or medical needs.